JUNE 10 — The Anwar administration has been signalling their intention to proceed with fuel subsidy rationalisation – removing subsidies for diesel and petrol — for some time now. There have been mixed responses towards the impending diesel subsidy. Some commentators like Geoffrey Williams claim the effects on overall inflation will be tame, while others preach caution as this could worsen the cost of living. All the while, the discussion around the issue cloaks itself with a sense of inevitability — can we really put this off forever when we can just do it now?

Yet, as many Malaysians are still recovering from the economic effects of Covid-19, one has to wonder if this is the right environment to add another factor to the inflationary pressure. Very little attention, if any, has been paid to the exact mechanism that generated inflation during the MCO years up till today. The simple economic ideas of supply and demand were used like a magic wand to wave away any deeper discussion of how inflation moves through our society.

Sellers’ inflation

German political economist Isabella Weber has popularised and advocated for the notion of sellers’ inflation as the explanation for drastically increased prices. At the heart of her conception of the idea is that prices are social relations, and businesses and customers navigate them as such. In her short explanation video on it, she describes a scenario where a customer of a coffee shop hears the owner complain about a coming rent increase for days. So when this customer pays more for his or her coffee the next day, this person makes the implicit connection between the repeated talk of a rent hike and the new coffee price. Yet, in this hypothetical scenario and many other real-world ones, few questioned the exact percentage of the price increases. This was likely the case in Malaysia after the lockdowns ended and the businesses operated normally. Adding to that was all the continued talk about how the war in Ukraine and Covid-related supply chain issues affected the prices of various goods on the international market. People were conditioned to accept the higher prices from businesses because there seemed to be an explanation for it.

Weber adds to this notion of prices as social relations with the understanding of economic shocks — like the Ukraine war and Covid supply chain issues — as indirect coordinators for price increases. In the same video, she states that “cost shocks can coordinate price hikes” and how it creates “an implicit agreement, almost like a cartel” to raise prices without worrying about losing market share to their competitors since everyone is doing it.

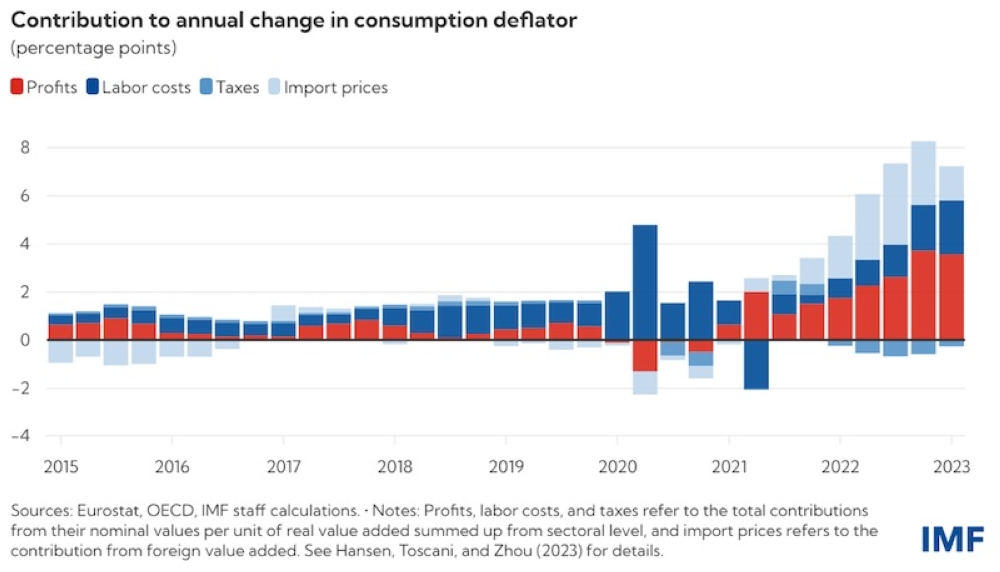

Research done by her and other academics has shown that the widespread phenomenon of sellers’ inflation generally benefited large corporations with enough market power to dictate the proportion of price hikes. International economic institutions like the OECD and European authorities have largely acknowledged this idea Weber has popularised. Almost a year ago, the IMF tweeted “Rising corporate profits were the largest contributor to Europe’s inflation over the past two years as companies increased prices by more than the spiking costs of imported energy.”

I would not be the only one who has raised the possibility of firms and retailers taking advantage of the shock to raise prices. In all likelihood, this has happened to Malaysia and will happen again during the rounds of rationalisation.

Recovering lost profits from the pandemic

In addition to the expectation of inflation after the end of MCOs, there was the fact that many Malaysians lost their livelihoods and had to go into debt to survive those years of hardship. With so little government aid during those times, people are desperate for a way to reclaim their losses. For businesses, especially with added liabilities and debt, there are largely two ways to increase revenue and profits: suppress wages and salaries or raise prices. Given the continual labour shortage — in large part due to the government crackdown on migrants, both legal and illegal, the only option left for many businesses was to raise prices.

It would have been perceived as undignified and unfair for businesses big and small to say that we are raising prices simply to pay off our debt and replenish reserves. Yet, this is the most likely scenario given that many still need cash to reproduce themselves and their businesses daily. There is no clearer indication of this than the EPF withdrawals since the start of the pandemic and the recent movement after introducing the more flexible Account 3.

How fuel subsidy rationalisation might play out

So with these two phenomena at play — sellers’ inflation and the need to recover Covid-era profits, any cost shock like fuel subsidy rationalisation would trigger another round of inflation above and beyond the proportion of the fuel price hikes or fluctuation. A mini-example of this played out when the Malaysian Hotel Association claimed that prices would go up by 30 per cent due to the increase of SST from 6 per cent to 8 per cent, to much ridicule on social media. This ridicule was very much justified from the perspective of normal inflationary math. To make things worse, their appeal to the fact that Malaysian hotels are cheaper compared to our Asean neighbours seemed irrelevant to this context.

If my product costs RM5.30 from 5 inputs (RM1.06 + RM1.06 + RM1.06 + RM1.06 + RM1.06) with each of them already containing the 6% SST, an increase to 8% would lead to the product costing RM5.40 (RM1.08 + RM1.08 + RM1.08 + RM1.08 + RM1.08) and not RM6.00, RM7.00 or anything higher. However, from the standpoint of an industry that has seen record losses, hiking prices by 30% is needed to pay off debt and reexpand the business back to levels that are profitable again. Weber observed that “instead of lowering prices and boosting volume, many companies are making up for lower volume by boosting prices.”

What can / should be done about this

The primary aim of this article is for more people to understand how delicate the economic situation we are facing now despite how the economy appears to have gone back to normal. There are few incentives for business analysts and the government to talk about how sections of society are still facing difficulties in an environment where consumer sentiment and share prices are driven by how well they think the whole economy is doing. Unlike the West, Malaysia is certainly not facing a recession but regular people are not experiencing the rebound and recovery equally.

Economist Muhammed Abdul Khalid has spoken about how fuel subsidies do little to help the poor who do not use fuel as much as the middle and upper classes. He has spoken about this since before the pandemic and recently again on Astro Awani, asking to raise wages instead. I wholeheartedly agree with him on increasing incomes for the poor in Malaysia. However, as their earnings are indirectly tied to the cost of living, petrol and diesel subsidies play no small part in keeping the price of food and other essential goods relatively low, allowing them to reproduce themselves daily. Any sudden moves to remove them would trigger some price change that could induce suffering among those in our society who live paycheque to paycheque, or worse yet, those in debt. There is no escaping the fact that fuel costs are baked into everything we consume, from groceries to delivered parcels and food to services.

Considering what I have discussed about sellers’ inflation and lost profits from Covid, I want to reiterate the caution that Noor Azlan Ghazali of Universiti Kebangsaan Malaysia has put out. He has highlighted the need for more clarity on questions like: How fuel prices are determined daily? Will there be a difference in price for urban and rural areas? Will there be a limit to the changes within a period of time? These answers are crucial to setting expectations for sellers and consumers. There is certainly an environmental case for removing the subsidies but this cannot be the reason to throw caution to the wind, especially when the consequences would ripple through our society for many years to come.

I want to end this article by echoing those who have called for gradualism in implementing the rationalisation. Returning to Weber, her award-winning book, How China Escaped Shock Therapy studied how the Chinese government managed the policy of removing price controls as the country moved from socialism to a market economy. China avoided the price spiral of Russia’s shock therapy by releasing the prices of less essential final goods before doing so for more essential primary goods and intermediate goods. This allowed for the prices of the former to stabilise first and firms were not able to ‘take advantage’ of more expensive inputs to raise prices above what would be nominally acceptable. The Anwar administration would do well to understand the gravity of these policy shifts, carefully consider the rationalisation in stages and push off those who call for the initiative to be done quickly.

Postscript: The diesel subsidy rationalisation is the form announced in the evening on 9th June 2024 could hardly be considered gradual. A more than 50 per cent increase with no stages of adjustment over a certain time period is bound to be perceived by firms and consumer as a shock. Despite the Budi Madani subsidies and the exemption for certain vehicles, it will not soften the notion among all Malaysians that prices of most goods will rise, even if they do not know what proportion is appropriate.

*This is the personal opinion of the writer or publication and does not necessarily represent the views of Malay Mail.