AUGUST 18 — The second quarter economic growth data will be released today and may show economic growth heading into new territory as well as a new phase in the business cycle, after the skyrocketing growth between Q4 2021 and Q3 2022.

The market consensus that growth may be between 2-6 per cent shows either an optimistic outlook or a highly uncertain outlook depending on your point of view.

The 4-5 per cent official target is within this consensus which implicitly assumes that the shock of the Covid-19 lockdowns is over and that the economy is converging towards the long-term growth path estimated at about 4.5-4.75 per cent.

Our analysis suggests that the Malaysian economy is much more complex than the rosy view of the consensus suggests and is not necessarily a smooth convergence to the long-term growth potential.

Instead an alternative and more difficult path out of the crisis may occur which has important implications for the policy priorities in the coming months and Budget 2024.

The two key questions to consider are: ‘What stage of the business cycle are we at in Malaysia?’ and ‘What will happen to the economy in the remaining part of 2023 and 2024?’

To put these questions into perspective we consider three points which are different from the market view.

First, the typical response of the economy following a shock such as the Covid-19 lockdowns is volatile before becoming smooth. Second, we focus on final demand and its key components, because overall GDP is biased due to statistical errors and changes in inventories. Third, we look at the “traction of the economy”, measured by the change quarter-on-quarter rather than year on year so that growth accumulates quarterly change over time.

When the economy experiences a shock, there is normally a response to that shock which has a very recognisable pattern.

In the case of the Covid-19 lockdowns, the shock contracted the economy into recession and the government at the time intervened heavily to try to counter the recession caused by the shock.

In the Malaysia case, there were multiple extensions of the lockdowns which made the shock worse than it needed to be. The data we have seen since the start of 2022 fits quite well with this stylisation.

The Q2 2023 GDP data will show that it has likely been a shift below the long-term growth trend. This opens the way to two possibilities — one short period below the long trend of growth and a second more pronounced and longer period of weakness for the economy.

The market view seems to be that there will be a shorter and shallower contraction while our analysis suggests the likelihood of a much slower annual growth of 2.5 per cent for 2023, roughly half of the official forecast.

Why the expected weakness ahead? The answer is that the Malaysian economy may have already experienced a period of technical recession if we look at the dynamics of the final demand.

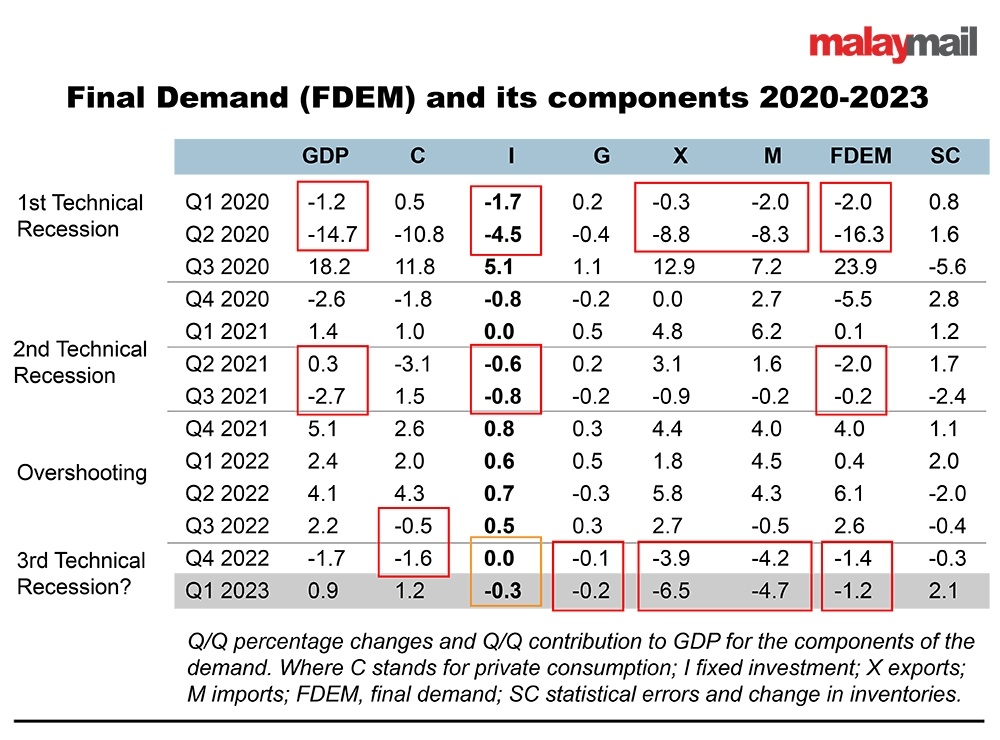

The table below shows quarterly growth of final demand (FDEM) and the contribution of its components.

From the table above we can see that the pattern of a possible third recession within four years is similar to the previous two in 2020 and 2021 judging from the negative growth investment which has only slightly avoided two quarters of contraction and external demand which has contracted for two quarters.

The more worrisome news is about the two consecutive quarters of contraction in private consumption and the two consecutive contractions in public government consumption expenditure.

There is a technical recession in final demand in the latest two quarters with a contraction of -1.4 per cent and -1.2 per cent respectively and this is more pronounced compared to the second technical recession of the second lockdown.

Since revenue and profits fuel the economy, final demand rather than GDP is often a better signal of underlying strength.

There are also two other factors that affect GDP which are stocks and statistics. Both of these have an effect on the GDP figures, pushing growth higher than the underlying data suggests.

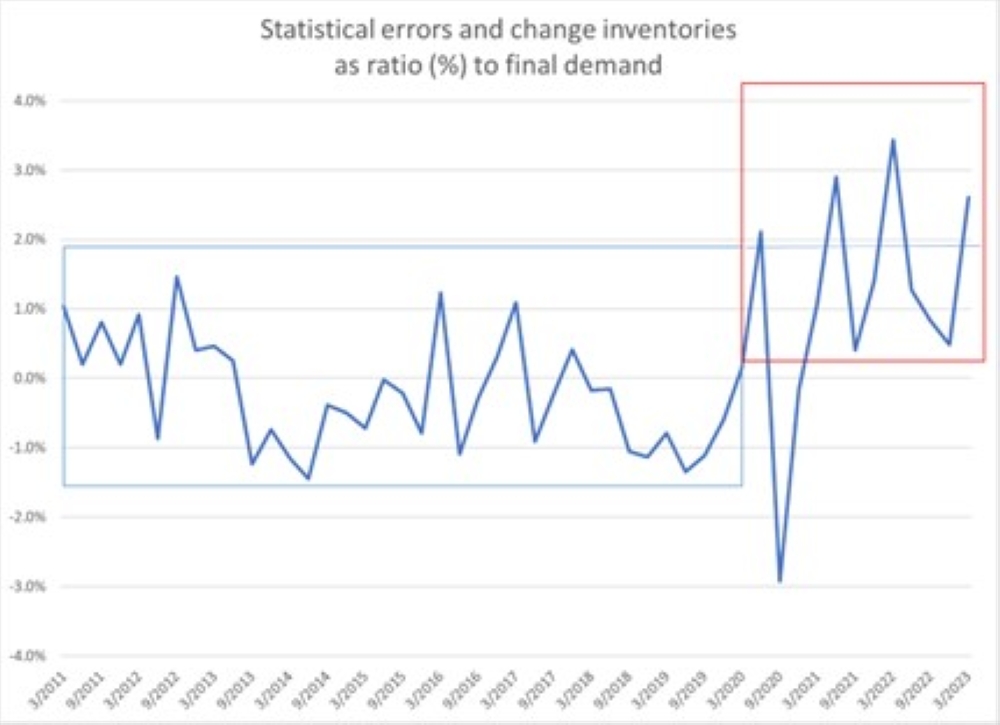

Looking at the effect of inventories and statistical adjustments on the GDP figures we can see that there appears to be a structural break in the last two years so that the combined effect adds more to the GDP figures after Covid-19 than in previous years before Covid-19.

Over the first part of the data, the “residual” given by statistical errors and change in inventories fluctuates around zero with a plus or minus in general between -1 per cent and +1 per cent.

In the period after Covid-19 the average of the residual is systematically positive, around the maximum of the previous period and it adds between 0-3 per cent to GDP in some quarters.

The systematic and positive level of this residual suggests an important measurement error that does not have a plausible explanation and it leads to a biased and too rosy interpretation of GDP.

The main implications of all this are for policy design. The government and Bank Negara can coordinate intervention to keep inflation low and protect the purchasing power of the population and on the other side, can keep supporting the economy, particularly investment activities with a proactive and expansive fiscal and monetary policy.

The volatility of the international economy adds additional doubts about a quick and smooth exit from the Covid-19 crisis.

Given this uncertainty, domestic policies should be ready to support any additional weakness of the economy in a coordinated and effective exit strategy from the remaining impact of the policy failures during the last few years.

* Professor Paolo Casadio is an economist at HELP University and Professor Geoffrey Williams is an economist and Provost for Research and Innovation at Malaysia University of Science and Technology.

** This is the personal opinion of the writers or publication and does not necessarily represent the views of Malay Mail.