KUALA LUMPUR, Aug 10 — Apple Pay is finally enabled in Malaysia and it allows you to make contactless card payments using your iPhone and Apple Watch.

At first glance, you probably think that this is nothing new since Samsung Pay could do the same thing when it was first introduced nearly six years ago. However, Apple has added a couple of extra features which makes it more convenient than Samsung Pay.

To recap, Apple Pay currently supports cards issued by three banks in Malaysia namely AmBank, Maybank and Standard Chartered. Both AmBank and Standard Chartered only support credit cards, while Maybank supports credit, debit and also prepaid cards.

Once you’ve added the cards, it will work with any contactless card terminals both in Malaysia and overseas. If you’re wondering how to get started, you can follow our Apple Pay Malaysia How-To guide.

Apple Pay doesn’t need PIN or signature for transactions over RM250

When it comes to contactless payments such as Visa PayWave or Mastercard PayPass, you can pay without entering a PIN or a signature if the transaction amount is RM250 and below. For any amount above RM250, you are required to sign or enter your PIN at the terminal to authorise the payment. This limitation also applies to Samsung Pay but not for Apple Pay.

Because of Apple’s tokenisation technology to safeguard bank details and all payments require Face ID, Touch ID or passcode, Apple Pay can allow transactions for any amount without entering PIN numbers at all. This means you can use Apple Pay to make a quick RM1,000 payment from your iPhone or Apple Watch. The only limit is the permitted amount set by your bank. If you’re using a debit card, the purchase limit for Apple Pay will follow your set limit which you can change via your online bank app or website.

Apple Pay works for in-app and website transactions

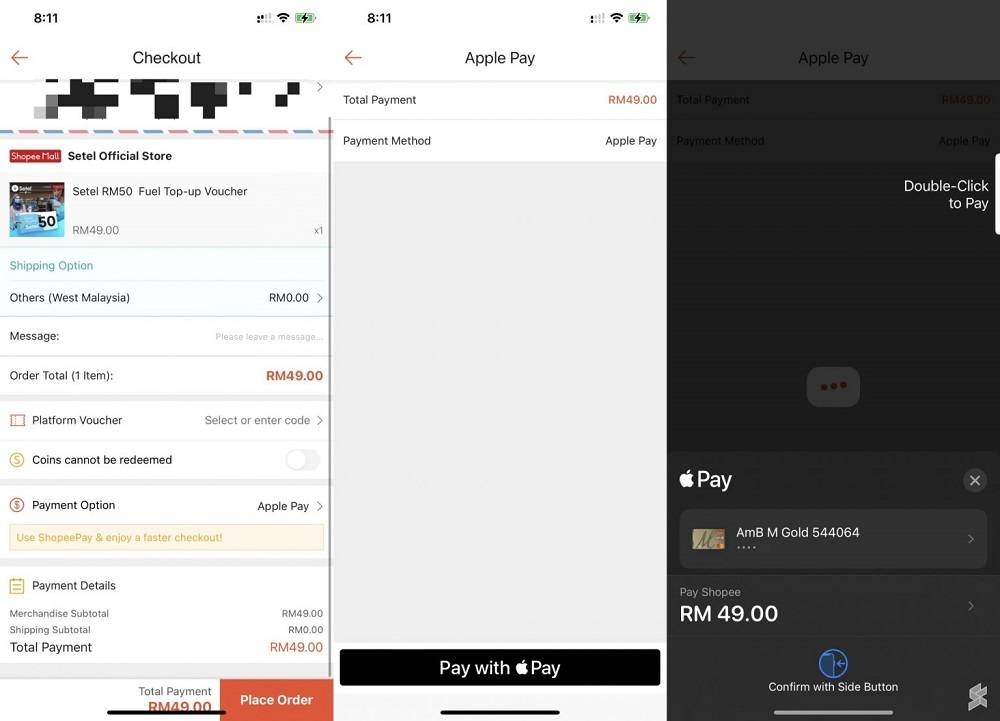

Besides physical in-store transactions, Apple Pay is also enabled for in-app payments and websites. Instead of entering your credit or debit card details with an eCommerce platform, you can just choose “pay with Apple Pay” for a faster checkout process and you don’t even need to wait for the OTP via SMS.

The “Pay with Apple Pay” feature is currently supported on Shopee, Sephora, Atome and Adidas. Take note that the Apple Pay integration for website is currently supported on the Safari browser across the iPhone, iPad and Mac. Similar to in-store payments, you’ll have to authorise the transaction using your device’s Face ID, Touch ID or passcode.

Features not available for Apple Pay in Malaysia

These are just a few features of Apple Pay which are currently enabled in Malaysia and it’s worth highlighting that Malaysia is the second country in Southeast Asia to get it. The other extensive features such as Apple Card, Apple Cash and money transfers via iMessage are not available in our market just yet. In selected markets, Apple Wallet also supports Transit cards which allows you to tap your iPhone or Apple Watch for public transport payments.

Other notable things that are missing are rewards or cashback when using Apple Pay in Malaysia. As a comparison, Samsung Pay provides points for every transaction which you can use to redeem vouchers and other promo items. Meanwhile, several eWallets in Malaysia are also offering coupons, coins and points for each eligible transaction.

Since Samsung Pay has been around since 2016, it has a wider support for banks which include Maybank, Standard Chartered, CIMB, Citi, Hong Leong, Public Bank, HSBC and RHB. Interestingly, AmBank isn’t listed as a supported bank for Samsung Pay. — SoyaCincau