SINGAPORE, Jan 27 — Chen Min, 23, recalled slogging her way through 2023 by juggling multiple part-time jobs and her bakery business, just so she could afford to buy a one-bedroom shoebox condominium apartment that was not meant for her own living purposes.

She also had to scrimp and save just so there was enough for her to cough up the S$200,000 (RM703,916) down payment for the apartment in Serangoon, she told TODAY.

“I would walk 30 minutes to an hour to save on bus fare,” she said of her penny-pinching days. ”I never snacked or bought drinks in school because all those few dollars and cents will be used to reinvest back into my (bakery) business.”

To Chen, who now lives elsewhere with her parents, the condominium unit is meant for investment purposes and not for her own occupation. As soon as the papers for the new apartment were signed, she rented out the shoebox apartment to help her earn a passive income.

She is one of many young Singaporeans who, in recent years, have turned to the private property market instead of public flats from the Housing and Development Board (HDB) for their first property purchase.

On Jan 18, real estate agency ERA Realty released a White Paper on the private property market that revealed a rising proportion of young Singaporeans are buying new private homes and that, in general, the profile of new private home buyers is “skewing younger”.

The report studied a sample size of 37,000 Singaporean new home buyers and is based on proprietary industry data from ERA Singapore.

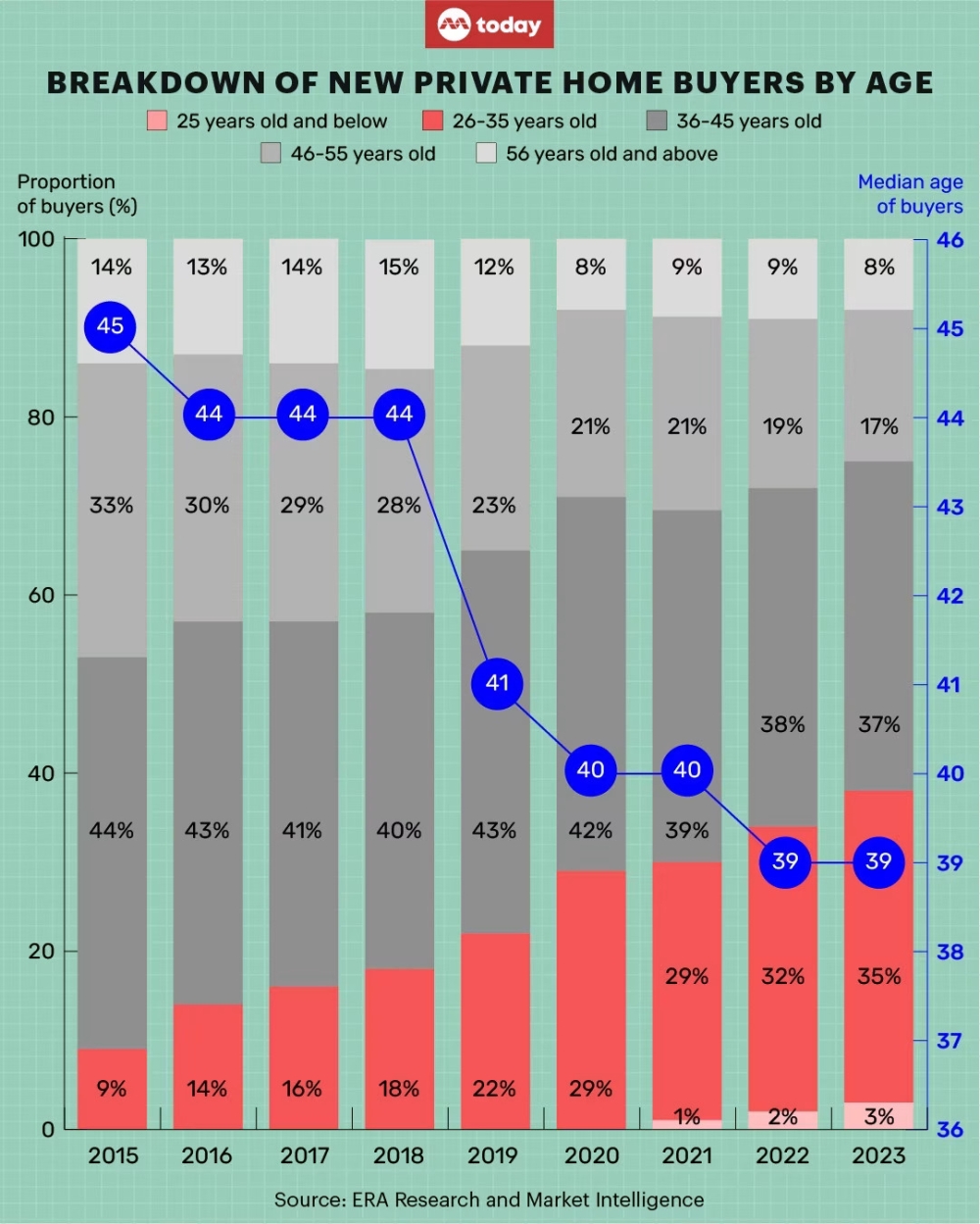

Over the span of the past nine years, the share of new private-home buyers aged 26 to 35 surged from 9 per cent of all new private-home sales in the country in 2015 to 35 per cent in 2023.

For those under 25 such as Chen, they represent 3 per cent of all new private-home buyers last year. Before 2021, such a demographic group of young home buyers was virtually non-existent.

As a result, the median age of new private-home buyers has “distinctly exhibited a downward trend” — falling from 45 in 2015 to 39 in 2022 and 2023.

Wong Shanting, ERA’s head of research and marketing intelligence who produced the report, said: “Mirroring housing markets worldwide, older Singaporeans have traditionally dominated the domestic market for new private homes, but there are now compelling signs supporting a noticeable shift in this widely held narrative.”

Asked why private condominiums are more appealing than subsidised public flats, several young Singaporeans told TODAY that it was a good asset class to grow wealth.

Diana, 30, who wanted to be known only by her first name and works in the real estate and built environment industry, said: ”The earlier you acquire this asset, the better.”

Three years ago, she bought her first private property — a one-bedroom condominium unit in Joo Chiat, which she also rents out to earn extra income. She opted for private property over public housing because she did not meet the age criteria and did not want to wait till she was 35 years old to buy an apartment.

For singles like her looking to buy an HDB flat, he or she must be 35 years old or older.

Others, such as real estate agent Andrew Phee and his wife Leslie Goh, a chief operations officer at an advertising and tech consultancy firm, they bought private property while they were still young because they needed more space for their family.

The couple, who are now both 40, bought their first private property when they were 33, upgrading from their 1,102-sqf four-room Design, Build, and Sell Scheme HDB flat to a 1,300-sqf three-bedroom condominium unit with a study room in Simei.

Last year, the couple moved again to a 3,000-sqf townhouse in Simpang Bedok with three storeys and a basement.

Phee said that while they appreciated their first home, it had a small living room, and they were expecting their second child along with a live-in domestic worker.

“We felt it would be nice to upgrade to a condominium with a bigger liveable space and facilities for the kids.”

Rising incomes spur private property purchases

One reason why more young people are buying private housing in the last nine years could be due to their growing affluence, which is represented by their rising incomes, ERA said in its report.

Referring to official labour statistics published by the Ministry of Manpower, ERA said that the median income for full-time employed residents rose for all age groups from 2016 to 2022.

In 2022, the median gross monthly income for full-time employed residents between the ages of 25 and 29 reached S$4,446, which marked a 16.9 per cent increase from S$3,803 in 2016.

For the group aged between 30 and 34, they earned S$5,792 — a 15.8 per cent increase from S$5,000 in 2016.

As a result, new private homes have become more accessible for young Singaporeans with growing incomes, ERA said.

The real estate agency also said that new private residences allow the buyer to pay in instalments for the home, which is especially helpful for young Singaporeans who may not have the income to cover the initial down payment of the condominium.

In general, the down payment for a condominium unit in Singapore is typically between 5 per cent and 25 per cent of the property’s purchase price.

If the buyer chooses to pay 75 per cent of the price with a bank loan, this means they would have to fork out a down payment of 25 per cent. Of this 25 per cent, 5 per cent must be paid in cash, while the remaining 20 per cent can be paid using cash or by drawing from the buyer’s account with the Central Provident Fund, the national savings scheme.

On this point, Lee Sze Teck, senior director of data analytics at property company Huttons Asia, said: “The income of the young buyers has increased over these few years, and many of them can qualify for a loan to purchase a private property.”

However, one analyst disagreed that growing income is the main reason for this trend, given that property prices have also risen significantly over the years.

Professor Qian Wenlan from the National University of Singapore (NUS) said that rising income could not be the main driving factor of young Singaporeans buying private property, because any analysis of housing consumption patterns here would need to consider property price inflation, among other things.

Prof Qian, who is director of the Director of the NUS Institute of Real Estate and Urban Studies, acknowledged that while median monthly incomes have increased by 38 per cent over the last 10 years, so have prices for non-landed private homes that grew by a substantially higher 52 per cent over the same period.

“Obviously, wage growth has not kept pace with property price growth, so funds for pricey private apartments would logically have to originate from other sources,” she added.

Of these “other sources”, Wong from ERA said: “Anecdotal observations by our (ERA’s) salespersons suggest a small proportion of young Singaporean home buyers received some form of financial help from their parents for their first home purchase.

“But in most cases, young Singaporeans were able to pay the equity portion of the purchase price themselves.”

Greater supply of condos, delays in bto construction

Apart from rising affluence, another property analyst believes that the changing supply of both private and public residential units may be another contributing factor.

Christine Sun, senior vice-president of research and analytics at property firm OrangeTee and Tie, said: “Just before the Covid-19 pandemic, there were more condominium launches, especially after the last en bloc cycle.”

An en bloc sale involves the sale of every condo unit within a development, as well as the land. In what was called an en bloc fever, 28 condominium estates were collectively sold at S$8.7 billion in 2017, and 38 condominiums sold for an estimated S$10.8 billion in 2018.

During the pandemic year of 2021, there were 31 condominium launches, including executive condominiums, which are public-private housing units developed and sold by private developers but subsidised by the Government. The 31 launches are slightly more than the 26 Built-to-Order (BTO) projects launched by HDB in the same year.

The pandemic-fuelled construction delays for BTO homes also likely caused prospective buyers to seek out other options. In 2021, more than 90 per cent of BTO projects were delayed beyond their estimated completion date.

“Due to the construction delays, some people turned to the private market, especially resale condos that are still affordable and ready for immediate occupation,” Sun said.

Investment value of condos

Referring to a poll by global investment firm Franklin Templeton, which found that as much as eight in 10 young Singaporeans between the ages of 18 and 35 are current investors, the ERA report said that this growing trend of active investing by the youth suggests that they are better able to accumulate the initial down payment and buy their first property.

After all, real estate is still widely regarded as a stable investment asset among Singaporeans, the report said.

“Private home offers opportunities for capital appreciation and passive incomes, which closely resonates with the young Singaporeans’ views on investing and building financial security at an early age,” it added.

Another significant factor could be that the recent spike in interest rates, which raises the cost of borrowing, are more likely to affect older Singaporeans.

Elevated interest rates would thus affect the mortgage eligibility of older Singaporeans more so than younger home buyers, which could cause some older buyers to shelve their plans indefinitely, the report said.

It also noted that going forward, the recent reclassification of HDB flats away from the current categories of mature and non-mature estates would make it more affordable to buy new public housing. Yet, at the same time, the tighter resale and rental options affect the value of such flats on the resale market.

“All of these conditions could have a moderating effect on resale price growth in the future,” Wong said in the report. ”Consequently, aspiring investors may shift their attention towards private homes, which could potentially yield better returns compared to HDB flats.”

Announced by Prime Minister Lee Hsien Loong during the National Day Rally last year, the classification of HDB estates as mature and non-mature will eventually be phased out and replaced with the Standard, Prime and Plus categories. The new Prime model is set to be introduced by the second half of this year.

For Roy Ng, who bought his one-bedroom condominium by himself at the age of 30 as a way to invest his savings, the wait to get an HDB flat at 35 was too long for his needs.

Furthermore, the freelance designer had aspired to live in private housing as a child. “I have never lived in private housing before, so it was something I wanted to try,” the 37-year-old said.

While some young Singaporeans still see living in private property as an aspirational goal, Chen who saved to buy her shoebox condominium unit believes that investment is the foremost aim for those seeking a condominium while in their youth.

Given the ever-increasing housing prices in Singapore, investing in private property is the best way to secure extra income, she added.

“I’ve always believed in property investing, especially in Singapore, because of how scarce our land is.” — TODAY