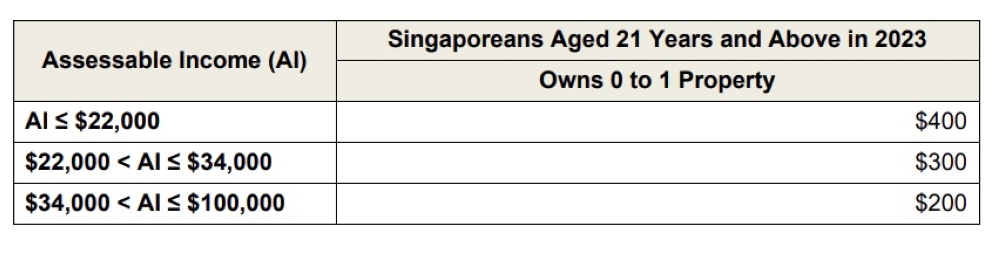

SINGAPORE — About 2.5 million adult Singaporeans will receive up to S$400 (RM1,345) in cash under this year’s Cost-of-Living Special Payment, with more support given to lower-to middle-income groups, said the Ministry of Finance (MOF) today (May 11).

In a press statement, MOF said that adults aged 21 and above in 2023 with annual assessable incomes of up to S$100,000 and who do not own more than one property are eligible.

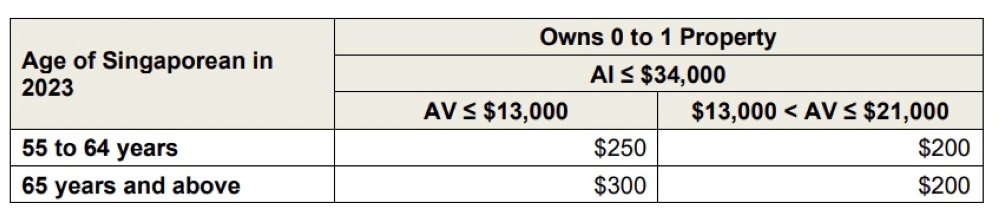

About 850,000 senior Singaporeans will also receive up to S$300 in cash under the 2023 Cost-of-Living Seniors’ Bonus to provide additional cost-of-living support for seniors.

This will be eligible to all senior citizens aged 55 and above with annual assessable incomes of not more than S$34,000, own only one property and whose residential address is a property with an annual value that does not exceed S$21,000.

Both payments will be disbursed together in June 2023, with eligible seniors receiving up to S$700 in total.

These are part of the enhanced Assurance Package announced by Deputy Prime Minister Lawrence Wong during Budget 2023 to help cope with high inflation and the Goods and Services Tax (GST) hike.

To receive the payments, eligible Singaporeans are encouraged to link their NRIC to PayNow if they have accounts with the ten participating banks by May 23, said MOF.

They will be able to receive their special payment and seniors’ bonus as early as June 7.

The ten participating banks include OCBC, UOB and DBS/POSB. Details can be found on the Assurance Package official website.

Those without PayNow-NRIC linked bank accounts can update their bank account information at the Assurance Package official website by June 5 to receive the payment by June 15, said MOF.

This is only available for DBS, POSB, OCBC and UOB banks.

Those who do not use the above two payment options can withdraw their payments at OCBC ATMs, under the GovCash service islandwide.

Govcash replaced cheques since 2022 as the mode of payment for citizens who have not linked their NRICs to PayNow or provided their bank account details.

It is a payment mode which allows Singapore citizens to withdraw their Government benefits in cash from OCBC ATMs at any time of the day.

For this method, a payment reference number, which will be sent to recipients from June 20, will be needed. An OCBC bank account is not required to withdraw the payment.

Notifications to guard against scams

Eligible recipients will be notified in June after the payments have been credited to them.

This will be informed either via their Singpass application inbox, or SMS for those who have registered their mobile numbers with Singpass, but have not downloaded or completed their one-time setup of the Singpass app, said MOF.

To guard against scams, the SMS notification will only inform Singaporeans of their benefits, MOF added.

Recipients will not be asked to reply to the SMS, click any links, or provide any information to the sender.

“There will not be any messages relating to the payments sent via WhatsApp or other mobile app messaging platforms,” said MOF.

Singaporeans can check their eligibility at the Assurance Package official website (go.gov.sg/assurancepackage) by logging in with their Singpass. — TODAY