SINGAPORE, Feb 9 — The number of scams reported in Singapore surged nearly one-third in 2022, with those aged under 40 the most likely to get ripped off in this way. Three in five of all scam victims last year were in this younger age bracket.

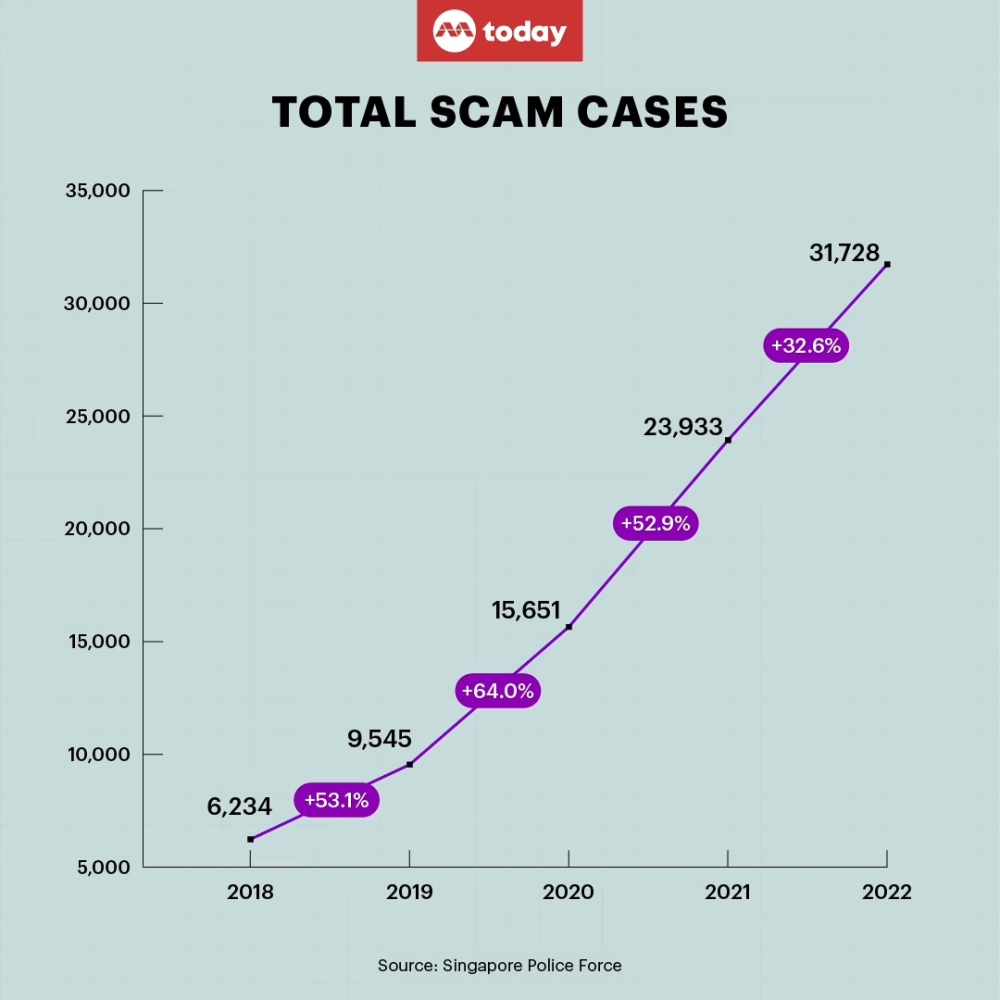

Data released by the Singapore Police Force (SPF) on Wednesday (Feb 8) showed that a total of 31,728 scams were reported in 2022, up 32.6 per cent from the 23,933 scams reported in 2021.

Still, the money lost to scams increased at a markedly slower rate, up only 4.5 per cent to S$660.7 million in 2022, compared with a year earlier.

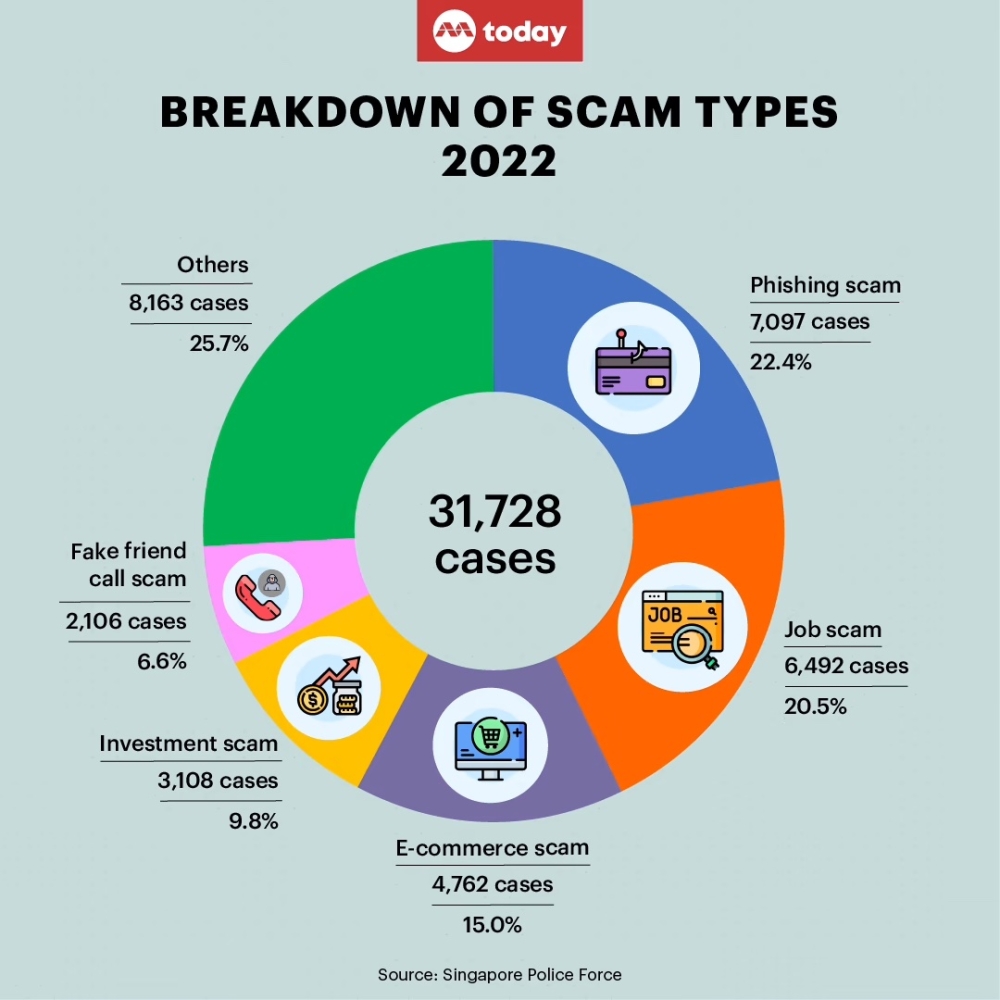

The top five scam types last year were: Phishing scams where data such as banking login details are stolen, job scams, e-commerce scams, investment scams and “fake friend” call scams.

On a positive note, the police reported a reduction in two types of scams:

• Internet love scams, where the victim is lured into believing he or she has formed a romantic relationship with the criminal

• Loan scams, where the victim gets conned into lending money to an apparently needy person, who is actually a criminal manipulating them

How were different ages groups affected?

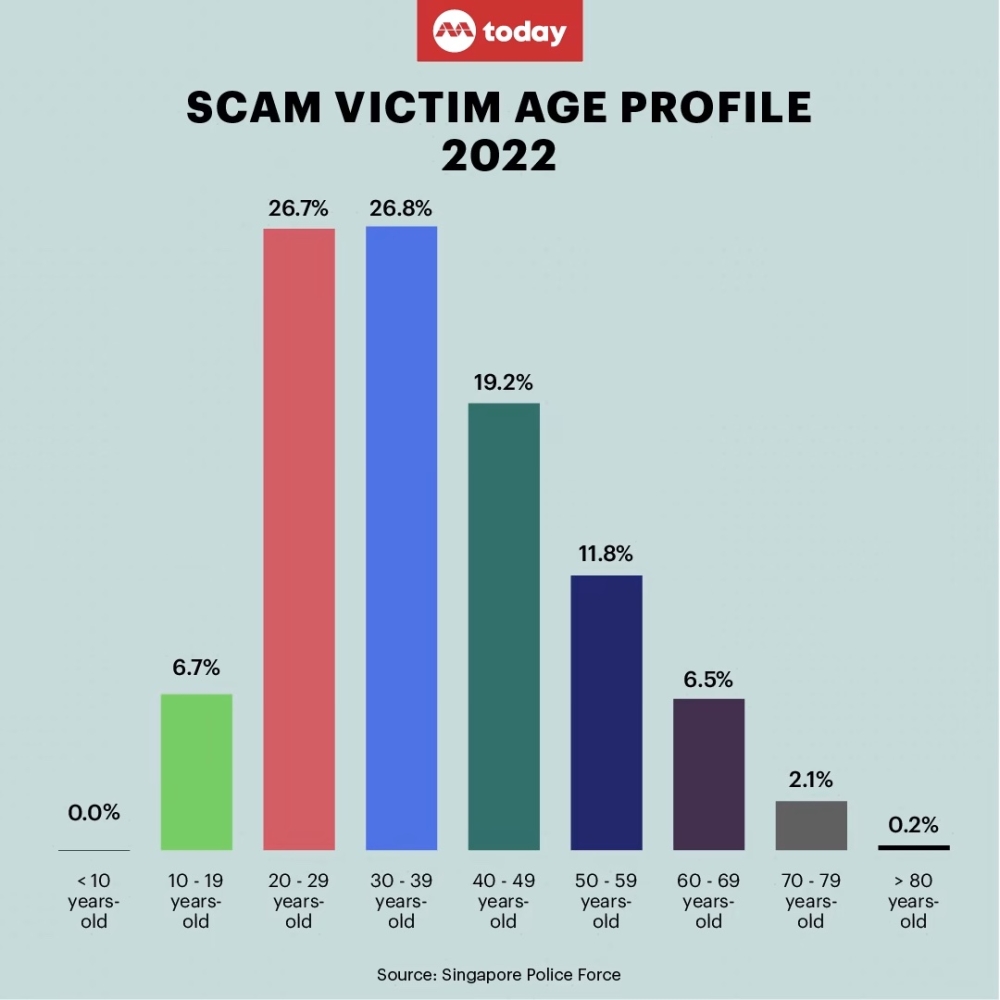

People aged below 40 accounted for 60.2 per cent of all scam victims. They were mostly contacted by scammers via messaging platforms, social media and online shopping platforms.

One key difference with those aged 40 and over is that phone calls were among the means often used to contact them, along with messaging platforms and social media.

• Youths, aged 10 to 19, made up 6.7 per cent of scam victims.

• Young adults, aged 20 to 29, accounted for 26.7 per cent of scam victims.

• Young adults, aged 30 to 39, made up 26.8 per cent of scam victims.

• Adults, aged 40 to 49, formed 19.2 per cent of scam victims.

• Adults, aged 50 to 59, made up 11.8 per cent of scam victims.

• Seniors, 60 and above, accounted for 8.8 per cent of scam victims.

What types of scams did they fall for?

In 2022, the most common scams — phishing scams, job scams, e-commerce scams and investment scams — was an unchanged list from 2021.

However, the fifth most frequent scam this year was “fake friend call scams”, which displaced loan scams, which had featured in the top five the previous year.

The police said in this type of scam, the criminal pretends to be a friend or acquaintance of the victim and then exploits this bond to ask for money transfers for various concocted reasons.

This number of reported cases of this type of scam trebled to 2,106 in 2022 with nearly half of victims aged 30 to 49. They lost at least S$8.8 million in 2022, up from at least S$4.5 million in 2021.

• Youths, aged 10 to 19, mainly fell for social media impersonation scams, phishing scams and e-commerce scams

• Young adults, aged 20 to 29, fell for job scams, e-commerce scams and phishing scams

• Young adults, aged 30 to 39, fell for job scams, phishing scams and e-commerce scams

• Adults, aged 40 to 49, fell for phishing scams job scams and e-commerce scams

• Adults, aged 50 to 59, fell for phishing scams, job scams and fake friend call scams

• The elderly, 60 and above, fell for phishing scams, fake friend call scams and investment scams

Which platforms were used by scammers?

The top three contact methods by scammers in 2022 were: Messaging platforms, social media and online shopping platforms.

In 2021, the top three contact methods were: Social media, messaging platforms and phone calls.

Messaging platforms

In 2022, the number of scam cases used by scammers to contact victims via messaging platforms jumped 49 per cent to 7,599 from 5,095 in 2021. WhatsApp was easily the most popular choice of scammers with 56 per cent of cases occurring on this app with Telegram in second spot at 36 per cent.

Social media

Scam cases in which scammers used to contact victims via social media rose 24 per cent to 7,539 in 2022, from 6,095 in 2021. About 60 per cent of cases involved Facebook, with around 34 per cent occurring on Instagram.

Online shopping platforms

The number of cases which scammers used shopping platforms to contact victims more than trebled to 4,818 in 2022 from 1,570 in 2021. Carousell was easily the most popular platform used by scammers, accounting for 89 per cent of reported cases, with Shopee in second spot at 6.6 per cent.

What can be done

While the police are continuing efforts to combat scams, such as coordinating in real-time with the Anti-Scam Command to tackle scam cases, they have also emphasised the importance of educating members of the public on the ways they can proactively guard against scams.

One of the ways that the police reach out to the public is through their anti-scam campaigns. One of this year’s campaigns that they worked on with other agencies, “I can ACT against scams”, encourages people to proactively protect themselves.

• Adding security features to devices, such as downloading the ScamShield mobile app and 2-Factor Authentication for personal accounts

• Checking for potential scam signs- asking questions, verifying the legitimacy of online listings and reviews, and pausing to check if SMS and message links are from legitimate sources

• Telling the authorities and platform owners about any scam encounters, as soon as possible, and also telling others about ongoing scams and what preventative actions they can take.

Additionally, various banks such as OCBC have also rolled out “kill-switches” so consumers can freeze their accounts in the event of a possible scam, or if they believe their account details has been compromised.

People can also refer to the E-commerce Marketplace Transaction Safety Ratings, to compare the safety features against scams the different e-commerce marketplaces have in place. These ratings can be found on the Ministry of Home Affairs website.

Mr David Chew, director of the police’s Commercial Affairs Department, said that to better protect the public against scams, the police will continue to work closely with other Government agencies and private stakeholders to strengthen public education and awareness efforts.

“Combatting scams is a whole of society effort, and members of the community play an important role,” he added. — TODAY