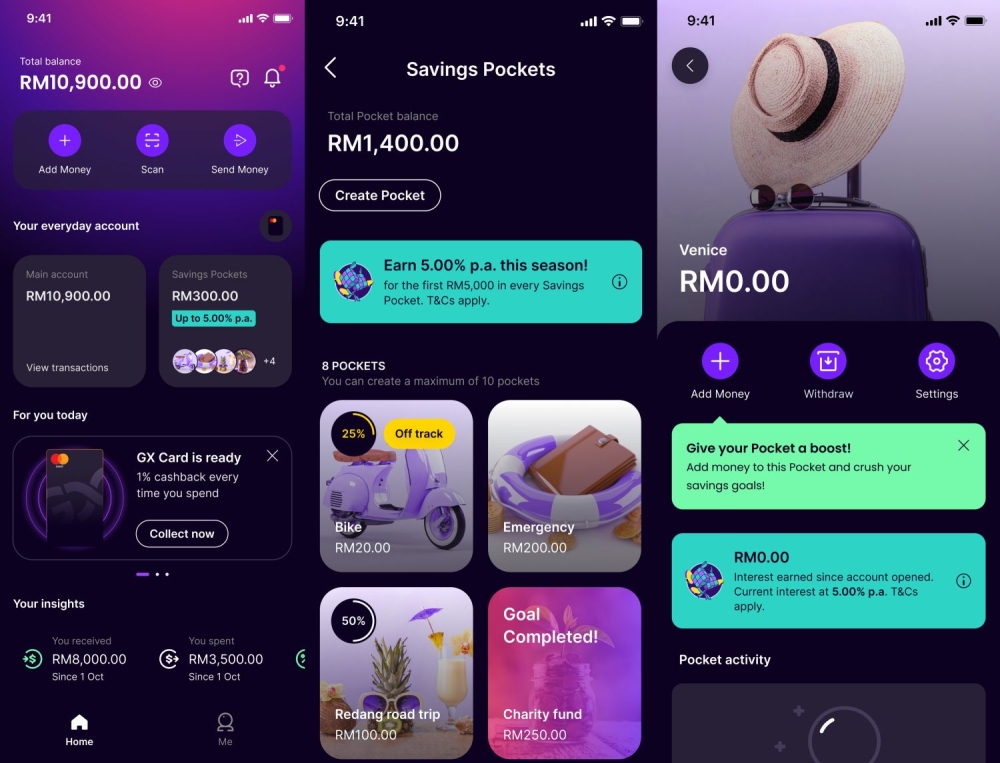

KUALA LUMPUR, April 2 ― For a limited time, GXBank account holders can enjoy a higher interest rate of 5 per cent per annum daily as part of their Raya campaign. According to GXBank, the new Savings Pockets campaign aims to encourage Malaysians to continue saving and take one step closer to their financial dreams while ensuring their festive needs are taken care of.

GXBank 5 per cent p.a. is running for a limited time only

The 5 per cent p.a. rate is applicable from April 10 until May 9, 2024, and is only for funds kept in the Savings Pockets. The campaign is open to all new and existing GXBank customers with fresh or existing funds in their Savings Pockets. This means balances in your main account will not be eligible for the campaign but you will still earn the standard 3 per cent p.a. rate.

According to GXBank, the campaign applies for balances up to RM5,000 in every Savings Pocket and each customer can create up to 10 Savings Pockets. This means you would be eligible to earn 5 per cent p.a. for total deposits of up to RM50,000 assuming you have a minimum of RM5,000 in each of the 10 Savings Pockets.

Unlike Fixed Deposits, GXBank says its Savings Pockets do not require a lock-in period and provide flexibility for customers to retrieve their funds when needed without the worry of losing their interest. The interest is credited to the GXBank account daily.

The full terms and conditions for this 5 per cent p.a. campaign will be published on their website on April 5, 2024.

GXBank is Malaysia’s first digital bank, which was rolled out to the public late last year. They are a member of PIDM and account holders are protected up to RM250,000. Users can make deposits via DuitNow bank transfers and spend their funds via GX Card Debit card and DuitNow QR.

GXBank is among five successful applicants to obtain their digital bank licence from Bank Negara Malaysia. Take note that GXBank offers conventional savings accounts and is not Shariah-compliant. If you’re looking for Islamic Digital Bank, the first player is Aeon Bank which has recently started registration of interest. ― SoyaCincau