KUALA LUMPUR, March 29 — Touch ‘n Go has officially launched Go+ today, its new investment feature which allows its eWallet users to earn daily returns with their balance. The provider aims to acquire 1 million Go+ users by the end of this year.

Here are five things you need to know about the micro-investment feature.

Anchored on Principal e-Cash Fund

Go+ is positioned as a financially inclusive investment product which allows Touch ‘n Go eWallet users and all Malaysians to gain access to low risk money market investments. Touch ‘n Go is the first eWallet in Malaysia to receive the green light from Securities Commission of Malaysia to operate as a Recognised Market Operator (RMO).

Go+ is positioned as a financially inclusive investment product which allows Touch ‘n Go eWallet users and all Malaysians to gain access to low risk money market investments. Touch ‘n Go is the first eWallet in Malaysia to receive the green light from Securities Commission of Malaysia to operate as a Recognised Market Operator (RMO).

The Go+ offering is anchored on Principal e-Cash Fund, a money market fund managed by Principal Asset Management (Principal). Principal is a joint venture between Principal Financial Group and CIMB Group Holdings.

The Go+ offering is anchored on Principal e-Cash Fund, a money market fund managed by Principal Asset Management (Principal). Principal is a joint venture between Principal Financial Group and CIMB Group Holdings.

RM10 to start

Touch ‘n Go eWallet users can start their investment with a minimum cash-in of RM10. This is available to all Malaysians who are aged 18 years old and above with a verified account. You can also make additional cash-in at any moment with a minimum amount of RM10.

Touch ‘n Go eWallet users can start their investment with a minimum cash-in of RM10. This is available to all Malaysians who are aged 18 years old and above with a verified account. You can also make additional cash-in at any moment with a minimum amount of RM10.

You can cash-in with your existing Touch ‘n Go eWallet balance or via online banking through FPX. The bank account must be linked to your IC number.

Returns credited to your account daily

Go+ allows you to earn daily earnings from your Go+ total balance. You must cash-in before 4pm to start earning the next day. If you cash-in after 4pm, you will start earning daily returns from the following day.

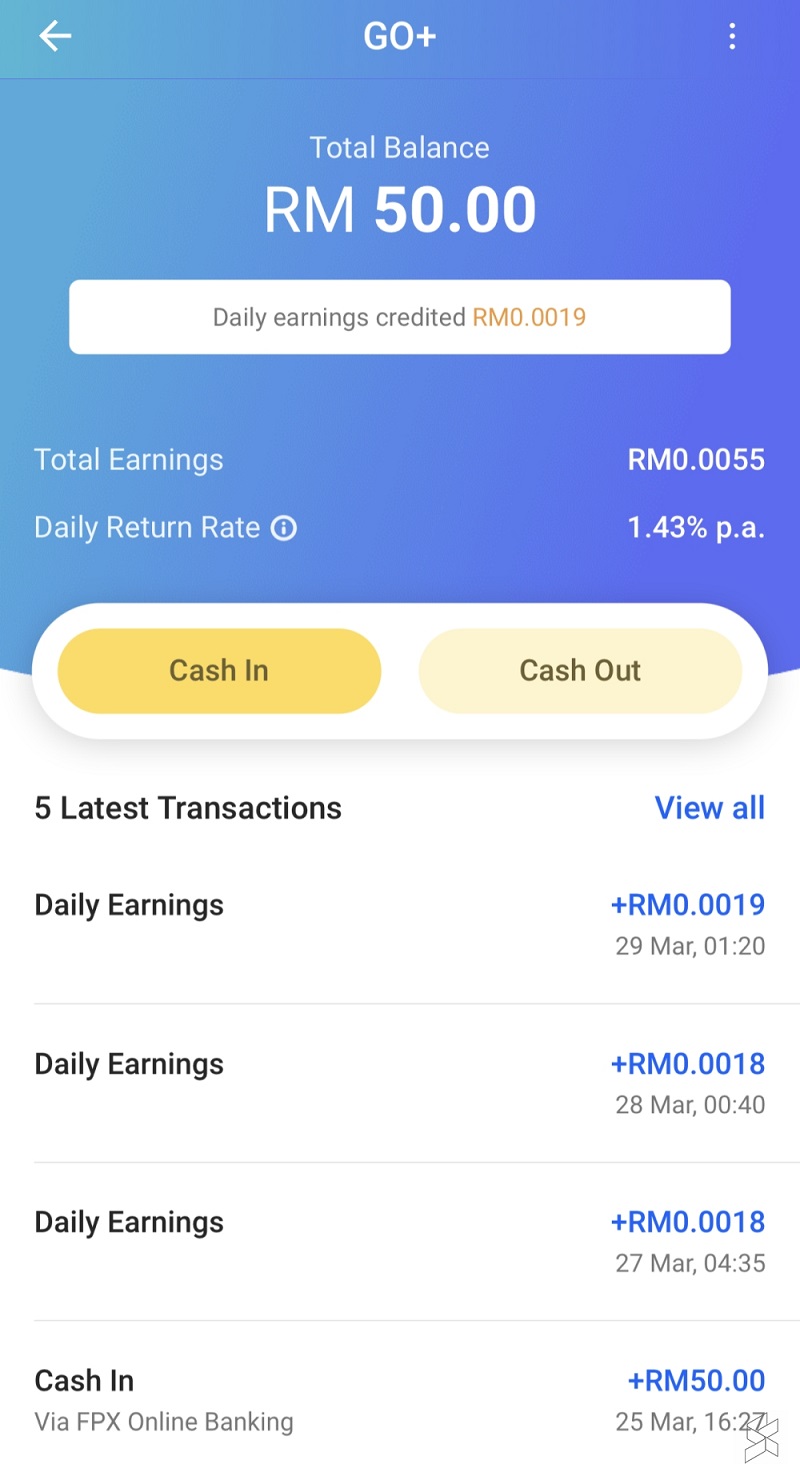

At the time of writing, the listed Daily Return Rate is at 1.43 per cent per annum. After 3 days, we have accumulated RM0.0055 in earnings with a RM50 cash-in.

At the time of writing, the listed Daily Return Rate is at 1.43 per cent per annum. After 3 days, we have accumulated RM0.0055 in earnings with a RM50 cash-in.

There’s no sales charge when you cash-in but there’s management fee up to 0.45 per cent per annum and a trustee fee of up to 0.03 per cent per annum. According to Touch ‘n Go, the eWallet will display net earnings after deducting the fees.

When asked about the low interest rate, Principal CEO Munirah Khairuddin said the e-Cash Fund isn’t meant to compete with fixed deposits. However, she shared that Go+ provides the convenience for users to make withdrawals at anytime with no uplift fees or penalty charges. At the current listed 1.43 per cent per annum, the returns are comparable to bank current accounts.

Not Shariah Compliant nor protected by PIDM

At the moment, Principal e-Cash that’s offered by Go+ is not a Shariah-compliant fund and it isn’t treated as E-money or deposit and it is neither capital guaranteed nor capital protected by PIDM. Touch ‘n Go understands the need of its consumers and a Shariah-compliant fund option is still in the works.

Cash out with no charge

Go+ users will have the option to cash-out directly to eWallet or to their local bank account. Cash-out to eWallet is done instantly while transfer to bank account will take one business day if the request is made before 4pm. Touch ‘n Go doesn’t impose any charges for making a cash-out request.

Go+ users will have the option to cash-out directly to eWallet or to their local bank account. Cash-out to eWallet is done instantly while transfer to bank account will take one business day if the request is made before 4pm. Touch ‘n Go doesn’t impose any charges for making a cash-out request.

If your Touch ‘n Go eWallet is low in balance, the Quick Reload Payment feature will automatically reload your eWallet with the exact amount required.

If your Touch ‘n Go eWallet is low in balance, the Quick Reload Payment feature will automatically reload your eWallet with the exact amount required.

To get started with Go+, just upgrade your account by tapping on the Go+ icon on the home screen. It’s now available on the latest TNG eWallet version that you can download on the Apple AppStore, Google PlayStore and Huawei AppGallery. — SoyaCincau