KUALA LUMPUR, Dec 17 — The Employees Provident Fund (EPF) recently introduced the Belanjawanku Guide, a comprehensive tool designed to help Malaysians understand and manage their financial needs across different household types and states.

The guide provides an in-depth view of the minimum monthly expenses required for various household situations, offering valuable insights into the cost of living nationwide.

One size doesn’t fit all

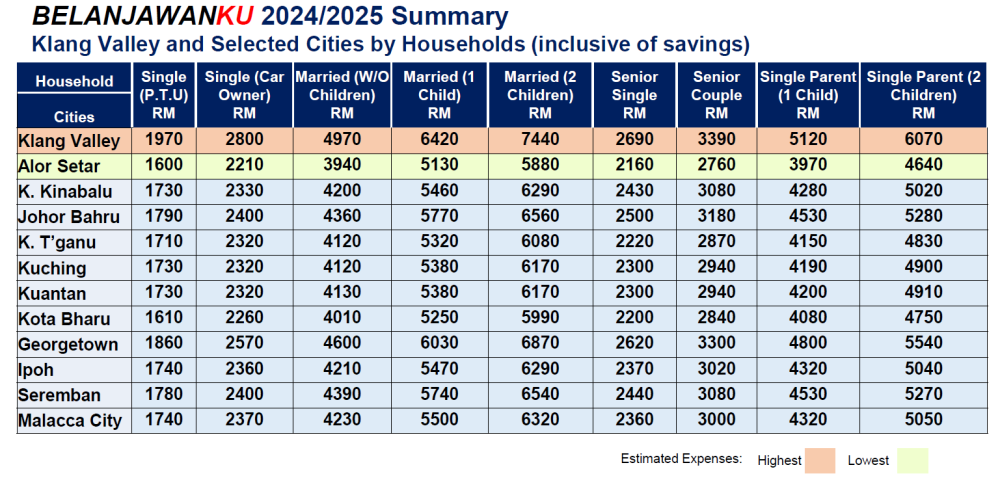

Recognising that financial needs vary based on household composition, the guide covers nine distinct household types.

These include single individuals, married couples, and senior citizens, with adjustments for major expenses such as vehicle ownership and childcare responsibilities.

This approach allows the guide to offer more accurate estimates of monthly expenses tailored to specific household scenarios.

However, these amounts are not fixed, as they are calculated based on the prevailing market prices of selected items at the time the survey was conducted.

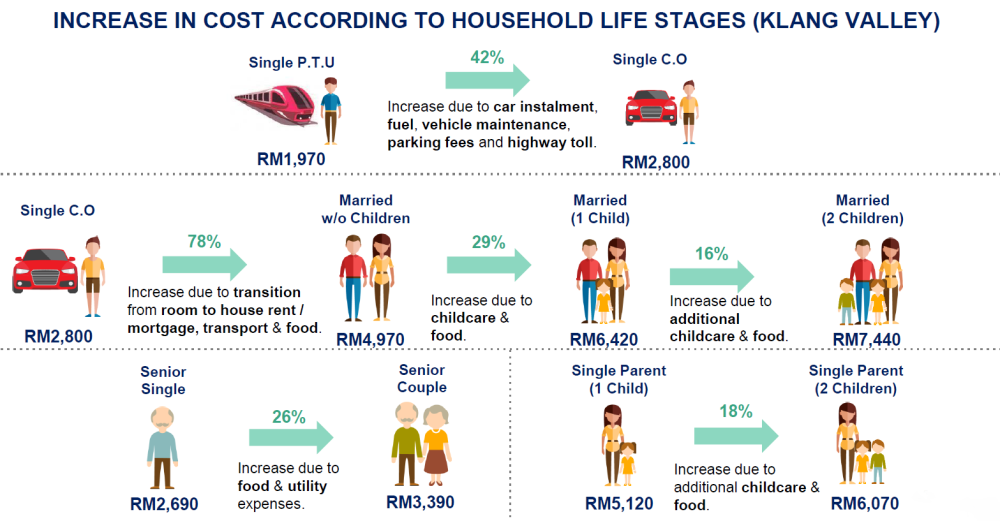

Public transport users save more

A key finding from the guide highlights the cost-saving benefits of using public transport.

Single individuals in the Klang Valley who rely on public transport reportedly spend 42 per cent less than those who own cars, mainly due to the absence of expenses like instalments, fuel, and maintenance.

For example, a single person using public transport in the Klang Valley spends approximately RM1,970 per month, while a car owner needs about RM2,800.

Ranking cities by cost of living

The guide identifies Alor Setar in Kedah as the most affordable city for single public transport users, with a minimum monthly expenditure of RM1,600.

In contrast, the Klang Valley ranks as the most expensive area, where the same demographic needs around RM1,970.

For couples with two children, the cost in Alor Setar is estimated at RM5,880, while in the Klang Valley, it rises to RM7,440.

George Town, Johor Baru, and Seremban are next in line as the most costly urban areas.

Evolving costs across life stages

The report underscores that living costs change significantly as households progress through different life stages.

In the Klang Valley, transitioning from single life to marriage can increase living expenses by 78 per cent due to changes in housing and transportation needs.

The arrival of a first child further raises costs by 29 per cent, with a second child adding another 16 per cent to the household budget.

Expenditure breakdown

The guide outlines major spending categories for Malaysians, noting that food and housing combined consume nearly half of a typical monthly budget.

Other expenses include utilities, healthcare, personal care, childcare, discretionary spending, social activities, and savings.

Development and purpose of the guide

Developed in collaboration with the Social Wellbeing Research Centre at the University of Malaya, the Belanjawanku Guide aims to provide a realistic picture of the monthly expenses needed for a decent standard of living. Initially focused on the Klang Valley, the guide now covers 11 major cities.

This initiative was partly motivated by rising bankruptcy rates among younger individuals, with the Department of Insolvency reporting that 55.6 per cent of bankruptcy cases involved those aged 25-44.

Key contributing factors include defaults on personal loans, business loans, and vehicle hire purchases.