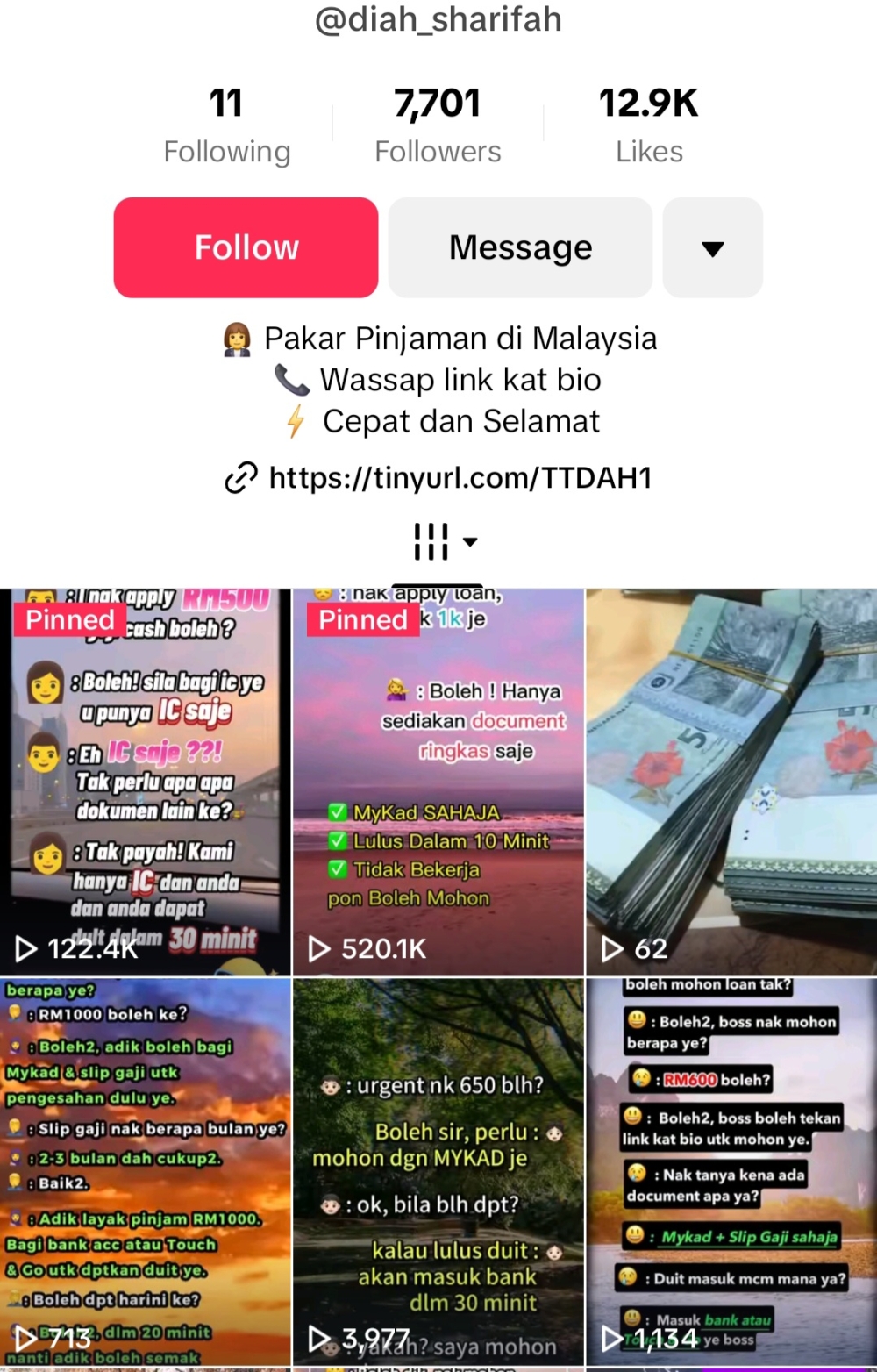

KUALA LUMPUR, Dec 3 — Loan sharks have traded posters on trees and lamp posts for flashy advertisements on social media platforms like TikTok, targeting school students in a worrying new trend.

The illegal lenders are luring students, particularly those hooked on online gambling or frequent travel, with offers of “emergency loans” or “quick loans” that appear easy and hassle-free.

The shift came to light when a 15-year-old boy from Selangor recently revealed he had racked up RM13,000 in debt to 12 loan sharks. The teenager said he borrowed the money to indulge his girlfriend’s craving for siakap tiga rasa — barramundi cooked in a spicy, sweet, and sour sauce.

While students may seem like unlikely targets due to their limited pocket money, loan sharks are finding the strategy profitable, thanks to the reach and influence of social media.

Isaac, a loan shark agent who spoke on condition of anonymity, explained that TikTok and other platforms have become lucrative avenues for illegal moneylenders.

“They hire agents to scout for influencers with a large following, offering them advertisement deals to promote loan services,” he said.

This new tactic highlights how loan sharks are evolving to exploit digital platforms, raising concerns about the risks posed to vulnerable young users.

He said some social media influencers can earn up to RM2,000 by pinning loan shark advertisements on their pages for just two days.

If their followers show interest in borrowing money, the influencers connect them to an agent, who then refers them to the loan sharks.

“If you just type ‘loans’ on TikTok or Facebook, you’ll see many ‘ah long’ advertisements using phrases like ‘emergency loans’, ‘fast loans’, or ‘loans for those not working’.

“No ‘ah long’ will openly admit they are one.

“School students usually borrow from loan sharks because they want to go on vacations or cover expenses that their pocket money can’t accommodate.

“Loan sharks typically lend between RM2,000 and RM5,000 to school students, charging interest rates of 10 to 20 per cent per week.

“They conduct background checks on the students, and the wealthier their parents are, the higher the loan amounts they approve.

“If a student introduces another friend to the loan shark, they receive a commission of about RM100 to RM200.

While it’s not a significant amount, students looking to make quick cash often fall for this,” Isaac told Malay Mail.

When students fail to repay their debts on time — which is almost always the case — their parents are often forced to step in and negotiate with the loan sharks for a lump sum settlement.

According to Isaac, the loan sharks typically demand that parents settle only the accumulated interest, which is still significantly higher than the amount initially borrowed by the student.

If parents refuse to pay, loan sharks resort to public shaming by putting up posters in the student’s neighbourhood, declaring that they owe money to ‘ah longs’.

To avoid such embarrassment, most parents end up paying.

Some parents, however, fall into deeper trouble by turning to middlemen who claim they can make the loan sharks go away. Isaac explained that these intermediaries often present themselves as champions fighting against illegal moneylenders on social media.

While they negotiate settlements on behalf of the victims, these middlemen secretly take a cut from the payment without the victim or the loan shark realising it.

“The victim believes they’ve fully settled the loan, but the loan shark continues to chase them, thinking there’s still an outstanding balance,” he said.