KUALA LUMPUR, Oct 14 — Malaysians are expected to get more cash handouts and tax incentives and reliefs next year to help them face a rise in living costs, as the government moves towards a more targeted approach to subsidies.

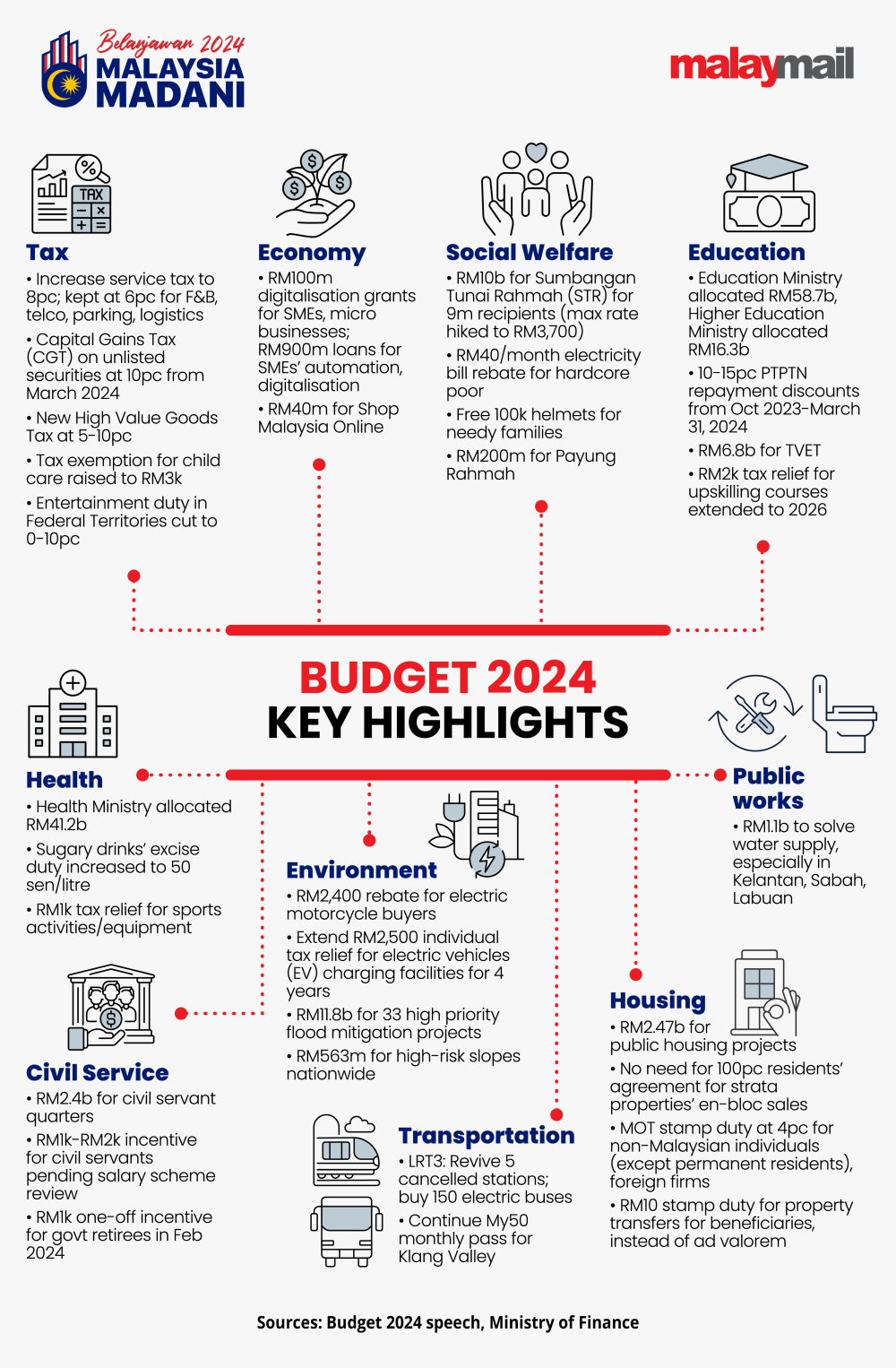

Here’s a summary of the highlights from the government’s proposed Budget 2024:

If you are in the lower-income category, here’s what you will enjoy:

Sumbangan Tunai Rahmah (STR) cash handouts

- Using savings by retargeting subsidies, the government can increase STR handouts from RM8 billion to RM10 billion, to be given to nine million recipients (60 per cent of adults in Malaysia). (The maximum you can get is increased from RM3,100 to RM3,700, while the minimum youths can get is increased from RM350 to RM500.)

- Sumbangan Asas Rahmah (SARA): 700,000 STR recipients who are hardcore poor will get RM100 every month for one year in their MyKad to buy necessities

- Electricity bill rebate at RM40 per month for hardcore poor to continue

- Free 100,000 helmets for needy families (including children)

- Free driving tests for motorcycle, e-hailing, taxi licences for 40,000 needy youths

- RM100 million for Skim Perubatan Madani for free healthcare at private clinics for 700,000 lower-income Malaysians

There’s something for everyone (regardless of income)

As for Malaysians belonging to all income levels, there are still policies that will help you with the cost of living:

- Those with National Higher Education Fund Corporation (PTPTN) student loans will enjoy discounts of 10 to 15 per cent from today (October 14) until March 31, 2024

- RM200 million for Payung Rahmah initiative, which has reportedly benefited over a million Malaysians through cheaper goods and services

- Continuation of My50 monthly pass for Rapid public transport in Klang Valley for its more than 180,000 users

- Income tax exemption for women returning to workforce extended until December 31, 2027 to reach target of 60 per cent female participation rate

- Residents of rural areas in Sabah and Sarawak to enjoy subsidised air travel with government allocation of RM209 million

- Beneficiaries will enjoy Memorandum of Transfer (MoT) stamp duty of RM10 instead of ad valorem (calculated based on property’s assessed value)

- Proposed reductions for the entertainment tax in federal territories from 25 per cent to a complete exemption for local artistes; five per cent for theme parks, and 10 per cent for international artistes, film screenings as well as sporting events and games

- Increase in income tax exemption on childcare allowances received by employees, or paid directly by employers to childcare centres, from RM2,400 to RM3,000

- The Employees Provident Fund’s (EPF) Caruman Sukarela Insentif Suri (i-Suri) programme for housewives has increased its government matching limit to RM300 per year limited to RM3,000 for life

- For the EPF i-Saraan programme, the government matching limit increased to RM500 per year limited to RM5,000 for life

- Continuation of the FLYsiswa programme which provides subsidised flight tickets for university students to return to their hometown

All these measures will help you with:

- Service tax rate proposed to be 8 per cent (except for sectors like food, telecommunications)

- Sugar-sweetened beverages’ excise duties increased to 50 sen per litre

- New Capital Gains Tax (CGT) at 10 per cent on shares of unlisted companies from March 2024

- A planned High Value Goods Tax at five to 10 per cent for goods such as jewellery, watches

- Removal of price controls on chicken, egg