KUALA LUMPUR, Aug 16 — Bank Negara Malaysia (BNM) only found out in 2015 following a foreign authority’s tip-off that 1Malaysia Development Berhad (1MDB) had in 2009 sent out US$700 million to the bank account of the wrong company — now known to be Low Taek Jho’s Good Star Limited, the High Court heard today.

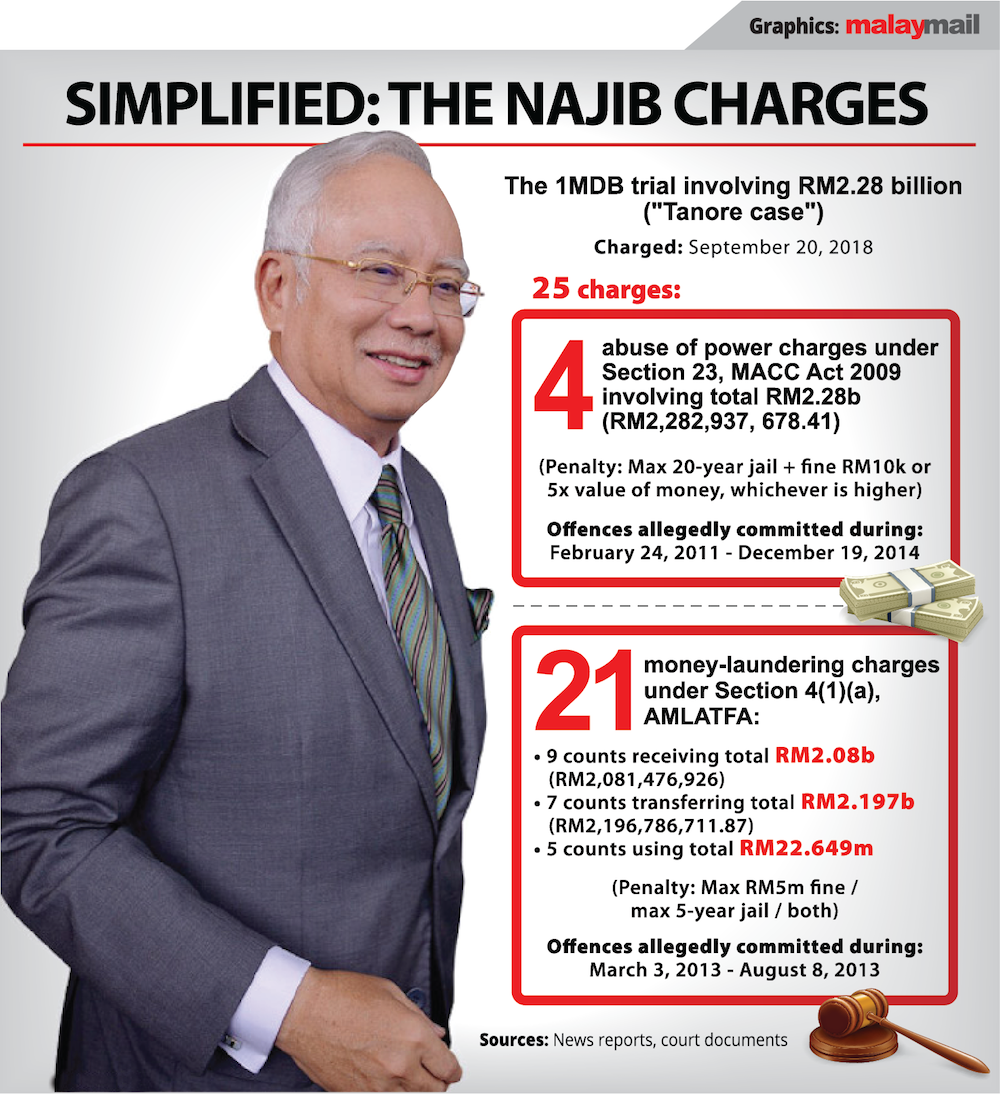

Former BNM governor Tan Sri Zeti Akhtar Aziz, testifying as the 46th prosecution witness in former prime minister Datuk Seri Najib Razak’s trial over RM2.28 billion of 1MDB funds, said the fact that this discovery came years later was not uncommon as investigations into such matters take time.

Zeti also said that 1MDB had provided false information in 2009 about the actual owner of the bank account, by saying that the bank account which would receive 1MDB’s US$700 million was a subsidiary of the joint venture company.

She also said BNM’s role — just like any other central bank in the world — was not to scrutinise every individual transaction as there was about US$12 billion worth of transactions every day in Malaysia then, and that it is the role of the individual banks or financial institutions — such as Deutsche Bank in this case — to carry out due diligence and carry out checks when handling customers’ transactions.

In 2009, BNM had approved 1MDB’s application to send US$1 billion out of Malaysia for a purported “investment” in a joint venture company between 1MDB and PetroSaudi, but 1MDB ended up sending it out to two different bank accounts on September 30, 2009: US$700 million to Good Star Limited’s RBS Coutts account and US$300 million to the joint venture firm’s JP Morgan account. Deutsche Bank was the one handling the US$700 million transfer.

Najib’s lead defence lawyer Tan Sri Muhammad Shafee Abdullah today asked: “So it is only seven years later, you would agree, that all your authorities realise that the money went to Jho Low, a wrong entity?”

Zeti replied: “That is correct.”

When Shafee suggested that this was an “awfully long period” to discover that the US$700 million was sent to the wrong entity, Zeti said: “It is not, it is very common, I was told by regulators and financial intelligence authorities all over the world, it takes several years to detect such cases.”

Asked who finally discovered this in 2015, Zeti said it was the cumulative efforts from regulators from different parts of the world, as well as investigations by BNM itself and BNM’s independent unit Financial Intelligence Unit via internal investigations that involved tracing a money trail.

With 1MDB not cooperating, Zeti said the FIU carried out the long process of tracing the money trail, given that the daily turnover of transactions in Malaysia's financial system had been then hit close to US$18 billion.

Earlier, Zeti said BNM did not know in 2009 that the RBS Coutts account receiving the US$700 million was Good Star’s account, and that it was only on March 20, 2015, when BNM carried out an on-site examination on AmBank and Deutsche Bank that it was discovered that the money had went into Good Star.

“Even then it had to be validated, who owned Good Star, and it was subsequently received, information that Good Star was not owned by the subsidiary of PetroSaudi joint venture,” she said.

Zeti rejected Shafee’s suggestion that BNM could have found out who owned the RBS Coutts account the day before the September 30, 2009 transaction, saying this is because the bank account is located in another country and “it takes time to find out who is the beneficial owner” of that account.

Even if BNM were to have suspicions and had made enquiries via the international banking system on who owns the RBS Coutts bank account, Zeti said it could take “weeks or months” for an answer to be given, as it would amount to an investigation.

She also pointed out that it is not BNM’s role to do such checks on individual transactions and that it would only get involved when an investigation is undertaken: “In a day, at that material time, the daily turnover of remittances and inflows and outflows was US$12 billion, so Bank Negara doesn’t undertake due diligence of individual transactions. The individual transactions — as required all over the world — are done by the financial institution, so you cannot say that is the responsibility of the central bank when this is not a function of the central bank to check each individual transaction when each day US$12 billion is undertaken.”

Shafee suggested that there was no evidence on paper to show that Najib had instructed any officers in Bank Negara or Deutsche Bank to make the US$700 million payment, with Zeti agreeing that it does not “appear in writing”.

Shafee then asked whether any such instruction by Najib appeared anywhere orally, with Zeti replying: “We would not be in a position to know at that material time.”

When Shafee asked “What about now?”, Zeti said: “We are not in a position to know what happened in the background.”

Zeti confirmed that Deutsche Bank itself would not be able to ask RBS Coutts directly who is the owner of the account receiving the US$700 million, as another financial institution would not reveal such information and that the information would have to come from BNM.

For the US$700 million transfer in September 2009 which 1MDB had purported to be for an “investment”, Zeti said BNM did ask 1MDB in August 2010 about the status of the investment but 1MDB was not able to provide any satisfactory answer, and that several emails and letters were sent to 1MDB to ask about the status of the investment but no information was forthcoming from the company.

She said this is why BNM rejected 1MDB’s 2014 application to send out more money and “put a stop to this scheme”, saying: “So it’s not that Bank Negara did not do anything, we were not able to get any information from 1MDB and their indebtedness kept on increasing and therefore the central bank rejected the application.”

As part of BNM's standard procedure to check on companies the following year whether they had used the money sent out of Malaysia according to the approval given by BNM, BNM officials had on August 6, 2010 met with 1MDB officials including 1MDB's then chief financial officer Radhi Mohamad to check on the status of the US$700 million sent out in September 2009.

Based on the minutes of the 2010 meeting shown to her, Zeti confirmed that Radhi did not inform BNM officials that the US$700 million had gone to Low's Good Star.

Asked by Shafee if there was any attempt by Najib to scuttle this meeting, Zeti said: "Not to my knowledge."

At the time of the September 2009 transfer of the US$700 million, the RBS Coutts account which received US$700 million was only known by its account number 11116073 and not by the name of its beneficial owner Good Star Limited, as 1MDB had left out the account's name when instructing Deutsche Bank to make the transaction.

Zeti agreed with Shafee's suggestion that in hindsight, 1MDB had purposely omitted Good Star's name so that BNM and Deutsche Bank would not know the name of the beneficiary of 1MDB's US$700 million.

Zeti was also referred to email exchanges within Deutsche Bank and between Deutsche Bank and 1MDB officials, with these emails all being on October 1 and October 2, 2009.

In one of those emails, Deutsche Bank (M) Berhad's former managing director (head of global markets corporate sales) Jacqueline Ho had on October 2, 2009 told 1MDB officials Casey Tang and Datuk Shahrol Azral Ibrahim Halmi that RBS Coutts had requested for the name of the US$700 million recipient to be revealed and said that Deutsche Bank awaits 1MDB's instructions on whether to reveal the name and address of the beneficiary to be given to RBS Coutts.

Shahrol Azral, who was the CEO of 1MDB then, had then replied in an October 2, 2009 email to ask Deutsche Bank to release the information that the September 30, 2009 payment of US$700 million was for the beneficiary Good Star.

Shafee: First time Shahrol said, which is on October 2, just a few days after the transaction, this beneficiary is Good Star, Good Star is owned 100 per cent by PetroSaudi International Limited, Shahrol gave information — totally a lie — that allowed this fraud to have existence. And this is the man you suggested to be charged?

Zeti: Yes.

Shafee also showed Zeti another email exchange internally within Deutsche Bank titled "1MDB change in beneficiary", where it was stated that Shahrol Azral had checked with PetroSaudi and reverted that the beneficiary of the US$700 million is PetroSaudi's subsidiary Good Star.

Zeti confirmed that BNM did not penalise or impose a compound on Deutsche Bank over the US$700 million transfer as the latter was not at fault, saying that it was 1MDB who gave the false information.

She also said Deutsche Bank did follow-up and queried 1MDB on the RBS Coutts’ account, and that Deutsche Bank was told that the account was a subsidiary of the joint venture but the purpose of the transfer remained the same.

Shahrol Azral, who was the ninth prosecution witness in Najib's 1MDB trial, had previously testified that he had on September 30, 2009 abruptly received an email from PetroSaudi International's (PSI) lawyers which asked 1MDB to transfer the US$1 billion into two new bank accounts (US$300 million to the JP Morgan account and US$700 million to the RBS Coutts account).

Shahrol Azral had said that PSI's law firm had given the two bank account numbers without providing the names of the account holders, and that he had subsequently texted Low who informed him that the RBS Coutts account belonged to Good Star Limited.

Najib’s 1MDB trial resumed this afternoon before judge Datuk Collin Lawrence Sequerah.

Later in the afternoon when asked by Shafee if none of the US$700 million had gone into Najib's account, Zeti replied: "I cannot confirm that."

Tomorrow, Sequerah is expected to hear Najib's application to recuse and remove him from continuing to hear the 1MDB trial.