KUALA LUMPUR, July 21 — Only 2.4 per cent of battery electric vehicles (BEV) or fully electric cars sold in six South-east Asian countries were in Malaysia, research on the first quarter this year has shown.

According to research firm Counterpoint Technology Market Research, more of the passenger cars sold in these six countries are now electric cars, with BEVs accounting for 3.8 per cent in total vehicle passenger vehicle sales in Q1 2023, as compared to just 0.3 per cent one year ago.

Citing its SEA Passenger Electric Vehicle Model Sales Tracker, Counterpoint said this meant passenger BEV sales in these six Southeast Asian countries grew by almost 10 times.

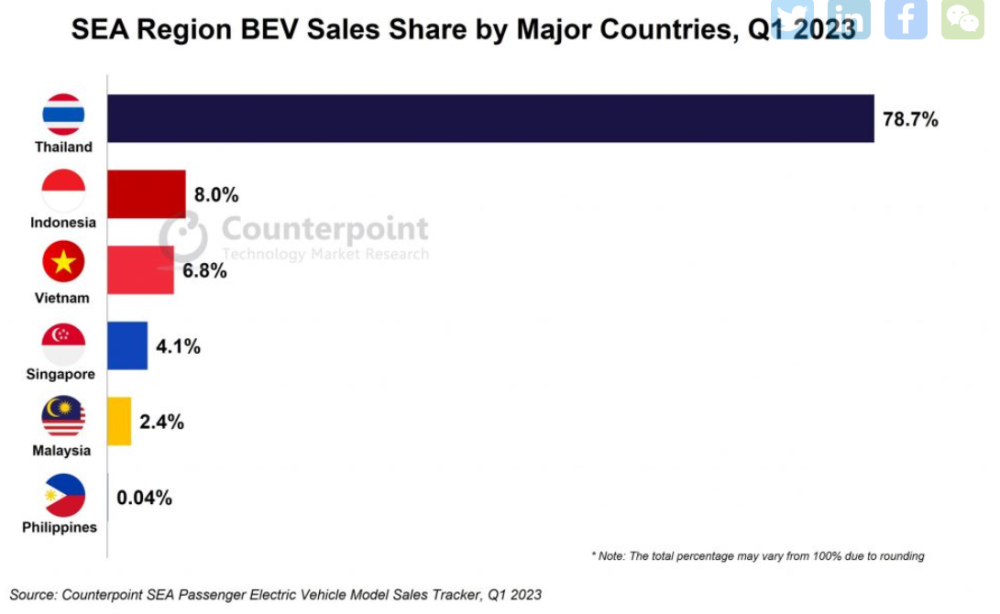

From its research released yesterday, Thailand leads in South-east Asia in terms of the number of fully electric cars sold there (accounting for 78.7 per cent of those sold in the six countries), followed by Indonesia (8 per cent), Vietnam (6.8 per cent) and Singapore (4.1 per cent), while Malaysia came in fifth at 2.4 per cent.

“Thailand also boasted the highest proportion of BEVs in total passenger vehicle sales, followed by Singapore and Vietnam,” Counterpoint said.

Counterpoint’s research analyst Abhilash Gupta said that Thailand’s government-led efforts to promote electric vehicle (EV) sales have yielded positive outcomes and that Indonesia and Vietnam are also performing well regionally in terms of such sales. “However, Malaysia, Philippines and Myanmar require additional regulatory support and encouragement to foster EV growth,” Gupta said.

Gupta also said the sale of BEVs have significantly and rapidly expanded despite overall passenger vehicle sales remaining relatively stagnant, also noting that the market for hybrid electric vehicles (HEVs) have had a remarkable growth in South-east Asia.

According to Gupta, China’s car companies’ market share within these six Southeast Asian countries have increased from 38 per cent a year ago to nearly 75 per cent.

He noted that the top three companies in terms of BEV or fully electric vehicles sales in the South-east Asia region in Q1 2023 are all from China: BYD Group (51.2 per cent), Hozon New Energy (9.6 per cent) and SAIC Group (8 per cent), or collectively 68 per cent of total BEV sales.

Counterpoint said the best-selling BEV in these South-east Asian countries is BYD’s Atto 3, followed by Neta V and Tesla Model Y.

In the same quarter, China’s Geely Holding Group had the highest sales for passenger hybrid electric vehicles (PHEV) in the region at 30.5 per cent, followed by BMW Group (22.8 per cent) and Mercedes-Benz Group (22.1 per cent).

The best-selling PHEVs model in the region was Volvo’s XC60, followed by the BMW 3 series and Mercedes-Benz E-Class, Counterpoint said.

Counterpoint’s sales data is based on wholesale figures, namely deliveries from factories by the respective brands or companies.

On March 1, the Ministry of Investment, Trade and Industry (Miti) announced US-based electric car company Tesla’s decision to establish its presence in Malaysia by setting up a head office, Tesla Experience and Service centres and a supercharger network here, adding that this is expected to create better-paying jobs for Malaysians and increase participation of local companies in Tesla’s ecosystem.

On March 1, Miti also announced its approval of Tesla’s application to import battery electric vehicles into Malaysia.

Tesla yesterday officially launched in Malaysia and also debuted its electric car Model Y to be sold at prices starting from RM199,000 and to be delivered to customers in early 2024.

Tesla customers can benefit from 100 per cent road tax exemption and individual income tax relief of up to RM2,500 on expenses related to EV charging facilities for assessment year of 2023, as well as full import and excise duties exemption for newly registered zero-emission vehicles.

In Malaysia’s Budget 2023, the Malaysian government had proposed various tax incentives to promote the use of EVs and support the EV industry, including to give a full income tax exemption on statutory income from assessment year of 2023 to 2032 for EV charging equipment manufacturers.

Budget 2023 had also seen the government proposing to give companies renting non-commercial EV a tax deduction of up to RM300,000 on the rental amount for the assessment year 2023 until 2025.

In Budget 2023, the government had also proposed an extension of existing tax exemptions on EVs, namely until December 13, 2027 for the full exemption on import duty for locally assembled EVs’ components and full exemption on excise duty and sales tax for locally assembled completely knocked down EVs; and until December 31, 2025 for full exemption on import duty and excise duty for imported completely built up EVs.