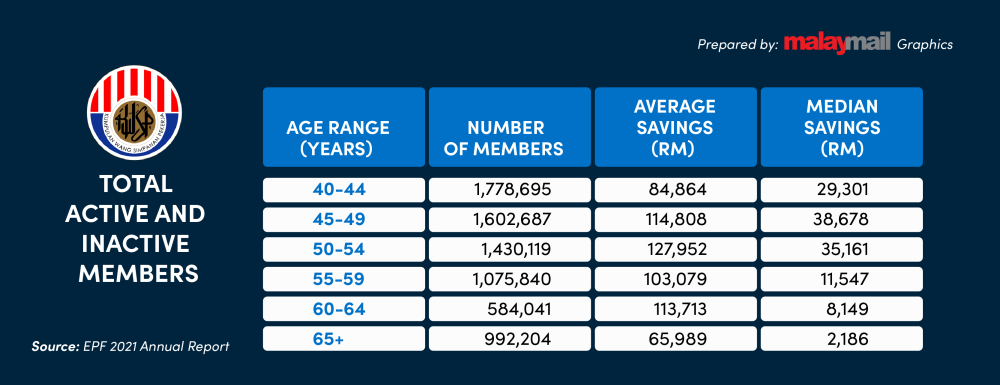

KUALA LUMPUR, March 9 — The Employees Provident Fund (EPF) today revealed that two million members aged between 40 and 54 have less than RM10,000 in their savings in their accounts.

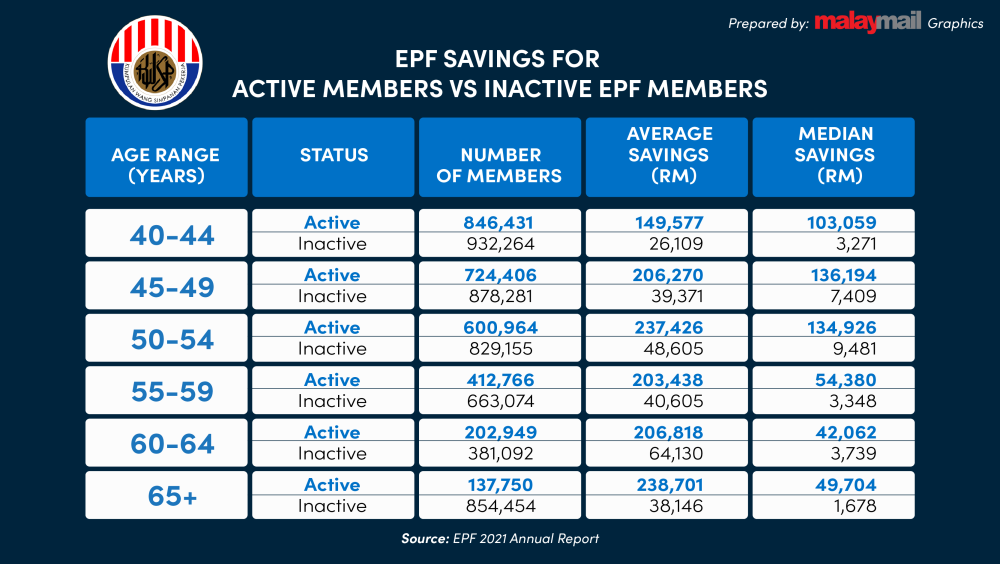

The country’s largest retirement fund also said that 2.64 million members out of the 4.81 members aged between 40 and 54 are inactive as they did not make any contribution for the past few years.

“The EPF places the highest importance on the integrity of member data and adheres to strict policies, controls, and audit procedures. This is in keeping with the EPF’s role as trustee and custodian of members’ retirement savings. “We would like to clarify that the table contained in the EPF 2021 Annual Report refers to active members only. As at end December 2022, there are actually 4.81 million EPF members in the 40-54 age range, with 2.17 million being active members and 2.64 million inactive members,” it said in a statement.

EPF said that lower starting salaries for those who began careers early before minimum wage was implemented in 2013 is among the factors to low overall member savings for this age group.

It also pointed out structural wage challenge as another reason where 44 per cent of EPF’s contributors earn less than RM2,000 and 81 per cent earns less than RM5,000.

“Inconsistent contributions due to members shifting in and out of the formal sector where only 45 per cent of 4.81 million members in this age group made contributions in 2022, while the rest did not contribute at all last year.

“Only half of the private sector labour force, who are under formal employment contracts, are mandated to contribute to the EPF. The remainder comprises individuals in other sectors, such as agriculture or informal work, or those who are contract workers and business owners,” it said.

EPF also said that a total of 2.85 million members or 59 per cent of members in this age group applied for Covid-19 related withdrawals and withdrew more than RM62 billion in total, which further reduced their savings.

EPF said that the Government’s one-off RM500 contribution initiative, which will be available to both active and inactive members, is a step towards boosting members’ retirement savings.

“This incentive will serve as a catalyst for members to rebuild their savings and achieve a dignified retirement, which in turn will help to mitigate the impact of Malaysia's rapidly ageing population. “Details on the programme are being worked out with the Ministry of Finance, subject to budget approval from Parliament, and will be communicated to members in due course,” it said.