KUALA LUMPUR, Feb 24 — The Employees Provident Fund (EPF) welcomed the proposed initiatives in Budget 2023 that were aimed at safeguarding Malaysians’ income security during old age.

“EPF is pleased that the Budget 2023 announced earlier today takes into account the demographic changes resulting in an increasing number of an aging population as well as the significant shift in the employment landscape from formal to informal employment,” EPF chief executive officer Datuk Seri Amir Hamzah Azizan said in a statement today.

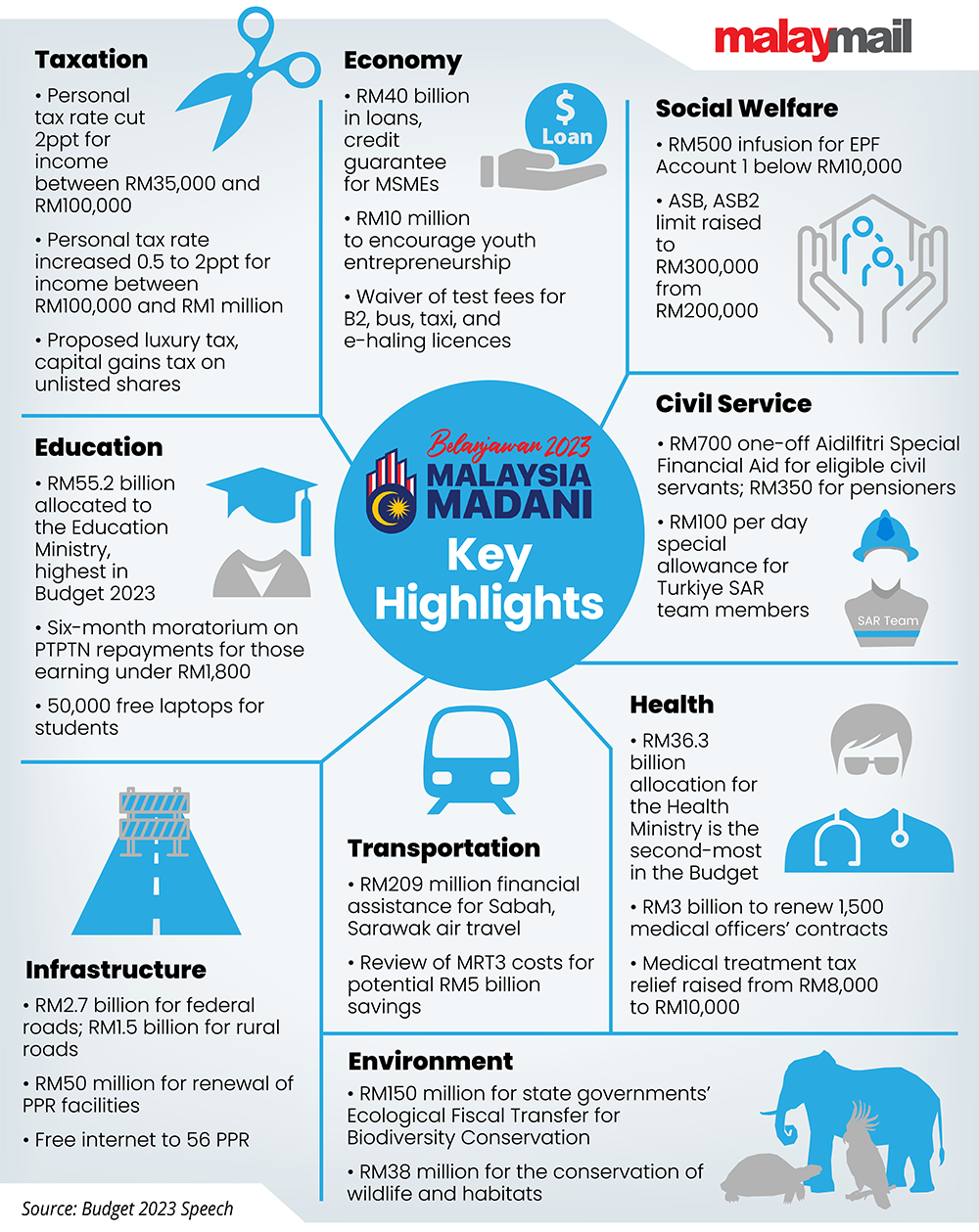

Amir was commenting on the proposal to contribute a one-off RM500 to EPF account holders with savings below RM10,000, extend the i-Saraan matching contribution scheme in 2023, expand the scope of tax relief for voluntary EPF contributions up to RM3,000, and the enhancement of EPF’s shariah savings accounts.

He added that the extension of i-Saraan and increasing the maximum limit of matching contributions from RM250 to RM300 per year will benefit members from the informal sector, especially housewives’ financial security for retirement.

Furthermore, he said the expansion of tax relief for voluntary EPF contributions to the limit of RM3,000 will encourage more Malaysians to increase their retirement funds.

In response to the government’s move to separate the assets of shariah saving accounts from conventional saving accounts, Amir said this will ensure shariah-compliant assets were invested fairly and provide competitive returns to its 15.7 million members.

“The wellbeing of Malaysians during their golden years remains a key priority and EPF will support the implementation of these initiatives to catalyse the accumulation of retirement savings for EPF members, with a view to helping them achieve a dignified retirement,” he added.

The Budget 2023 Prime Minister and Minister of Finance Datuk Seri Anwar Ibrahim tabled earlier today included proposed measures to address the low retirement savings among the bottom 40th percentile of income earners (B40).

Previously, the Ministry of Finance reported the total of EPF funds from B40 in April 2020 was RM13 billion, which fell by 46 per cent to RM7 billion last December due to the early withdrawal schemes allowed by Tan Sri Muhyddin Yassin’s and Datuk Seri Ismail Sabri’s administrations.

Between 2020 and 2022, EPF members were allowed four early withdrawals of not more than RM10,000 each time.

Since then, Perikatan Nasional MPs have continued to call for targeted EPF withdrawals to help Malaysians cope with the cost-of-living crisis, but the current unity government has declined to allow it.