KUALA LUMPUR, Feb 24 — Following are the highlights of Budget 2023 tabled in Dewan Rakyat today by Prime Minister Datuk Seri Anwar Ibrahim.

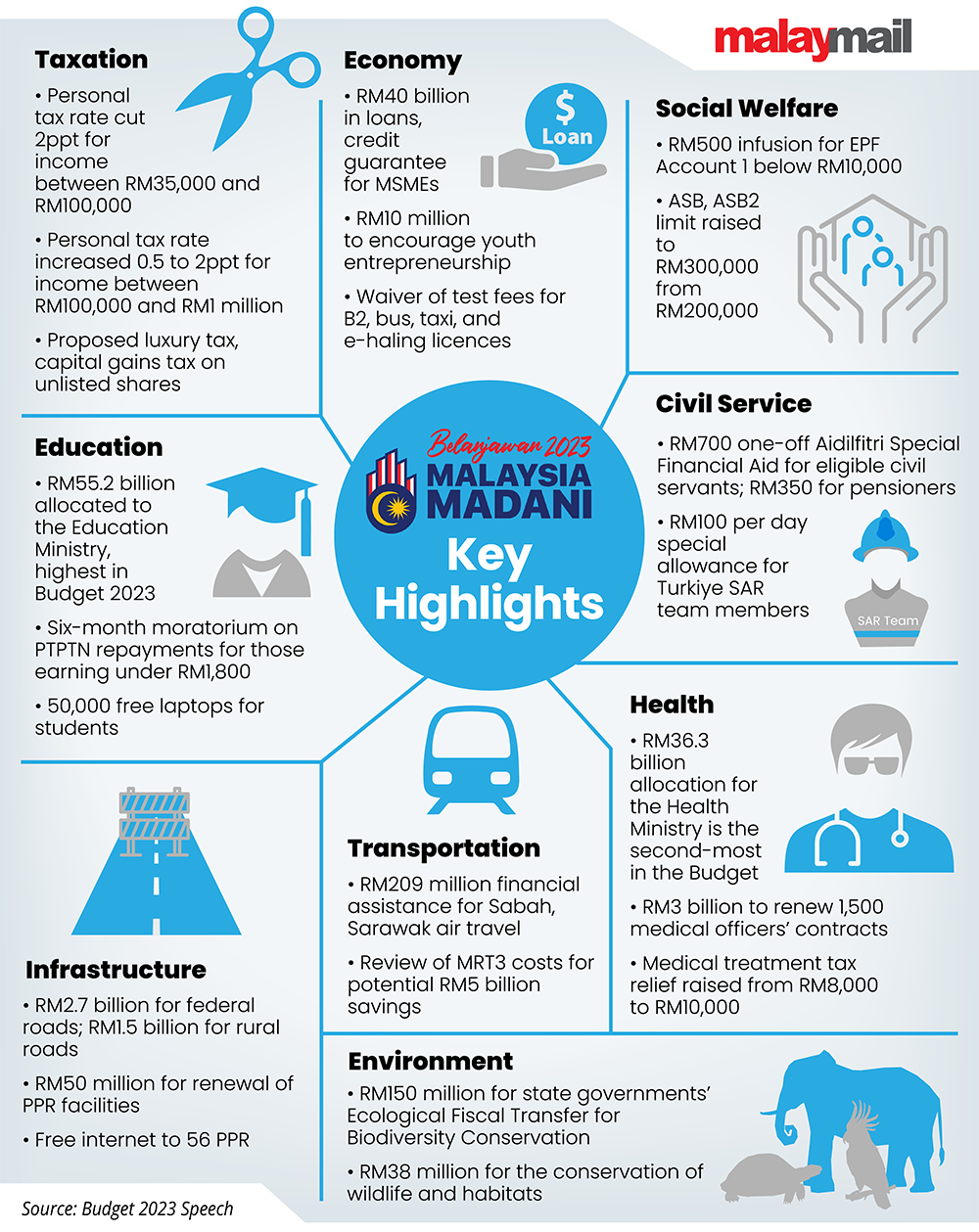

Themed ‘Developing Malaysia MADANI’, Budget 2023 involves an allocation of RM388.1 billion with RM289.1 billion for operating expenditure and RM99 billion for development expenditure, including RM2 billion as contigency savings.

Budget 2023 focuses on 12 main initiatives based on three objectives, namely, driving an inclusive and sustainable economy, institutional reform and governance to restore confidence, and social justice to reduce imbalance.

This is the first budget tabled under the Unity Government led by Anwar, who is also Finance Minister.

The earlier Budget 2023 was tabled by the previous government in October last year but could not be passed before Parliament was dissolved.

• Government proposes to introduce a luxury goods tax starting this year.

• Government plans to impose excise duty on liquid or gel nicotine products for e-cigarettes and vaping devices.

• RM50 million to build and upgrade 3,000 stalls and kiosks for small traders.

• To immediately re-tender six flood mitigation projects, including in Johor, Selangor and Kelantan.

• Disaster management preparedness: RM150 million for NADMA, RM50 million for Armed Forces, Bomba and RELA, RM20 million under Geran Pertubuhan Prihatin Komuniti to benefit 2,000 residents’ associations.

• The Ecological Fiscal Transfer for Biodiversity Conservation (EFT) allocation to state governments to be increased to RM150 million annually.

• Government allocates RM38 million for wildlife protection, such as tigers and elephants and their habitats.

• To combat corruption, government plans to amend the Whistleblowers Protection Act this year.

• RM1.2 billion to repair 400 dilapidated clinics and 380 dilapidated schools.

• RM2.7 billion to maintain and upgrade federal roads.

• RM1.5 billion to upgrade and construct new rural roads.

• RM10 million in operating grants to strengthen the roles of the National Scam Response Centre.

• Government to amend Insolvency Act 1967 so that bankruptcy cases can be automatically discharged at short notice.

• Bankruptcy cases with debts of less than RM50,000 that meet the conditions will be discharged immediately from March 1.

• A special team will be established under D11 to combat child pornography.

• Women, Family and Community Development Ministry to set up Child Development Department to provide comprehensive support services for children.

• Government to formulate Consumer Credit Act and establish Consumer Credit Oversight Board to regulate credit businesses.

• RM50 million for the National Dual Training Scheme (SLDN), to benefit 8,000 trainees.

• Social Security Organisation (Socso) hiring incentive of RM600 per month for a period of 3 months to employers who hire 17,000 graduates (especially TVET).

• Socso hiring incentives up to RM600 per month for a period of 3 months to employers who hire persons with disabilities, ex-convicts, homeless individuals and unemployed.

• RM50 million in matching grants to encourage the automation of the plantation sector through the use robotics and Artificial Intelligence.

• Childcare fee subsidy of RM180 per month to government servants, household income limit to be increased from RM5,000 to RM7,000.

• To continue construction of 80 KEMAS taska and tabika, including 13 new projects.

• RM250 million for tourism promotional activities.

• To address congestion in tourism spots: RM480 million to build new road from Habu to Tanah Rata, Cameron Highlands, Pahang, and RM525 million to upgrade North-South Expressway from Yong Peng Utara to Senai Utara from four lanes to six lanes in stages.

• RM725 million to improve digital connectivity in 47 industrial areas, nearly 3,700 schools.

• Government to ensure Digital Economy Centre (PEDi) facility in each state constituency before the end of this year.

• RM30 million to improve liveability in public housing in Kuala Lumpur.

• RM50 million to Melaka and Penang to maintain UNESCO world heritage sites.

• RM750 million to Economy Ministry to implement Inisiatif Pendapatan Rakyat (People’s Income Initiative).

• Government allocates up to RM64 billion in subsidies, aid and incentives to minimise cost of living.

• RM100 million to implement Jualan Rahmah programme in every parliamentary constituency.

• Households with income less than RM2,500 eligible to receive Sumbangan Tunai Rahmah up to RM2,500, depending on the number of children.

• RM200 in e-Tunai Belia Rahmah credit, involving an allocation of RM400 million.

• RM1.6 billion to provide various subsidies and incentives for padi farmers.

• Cash aid of RM200 per month for three months or one season, to benefit 240,000 padi farmers.

• Monsoon aid for smallholders to be increased from RM600 to RM800 for a period of four months, to benefit 320,000 individuals.

• M40: Income tax rate for individuals in the RM35,000-RM100,000 income band will be lowered by two percentage points.

• Income tax rate for individuals earning over RM100,000-RM1 million annually will be increased between 0.5 and two percentage points.

• RM30 million to implement agro-food projects with several state governments.

• RM50 million to maintain and repair non-Muslim houses of worship nationwide.

• Sabah, Sarawak to receive RM6.5 billion and RM5.6 billion, respectively, for development.

• Over RM2.5 billion for public infrastructure projects in Sabah, Sarawak.

• RM30 million to add more mobile clinics, banks and courts to facilitate rural folks in Sabah, Sarawak.

• Home Ministry and Defence Ministry to receive RM18.5 billion and RM17.7 billion, respectively.

• To add 42 border control posts for General Operations Force, Immigration Department, ESSCom and Malaysian Maritime Enforcement Agency. — Bernama