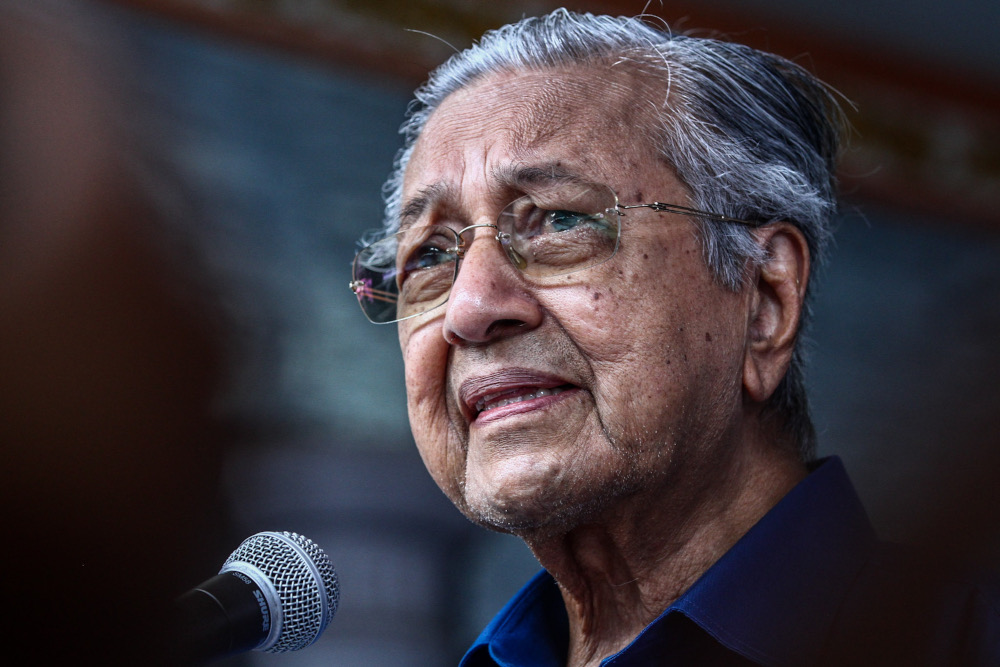

KUALA LUMPUR, May 11 — Former prime minister Tun Dr Mahathir Mohamad has suggested the government consider the currency peg used during the Asian Financial Crisis (AFC) to address the ringgit’s current fluctuation on the foreign exchange market.

Dr Mahathir said the global economic uncertainty resulting from the Covid-19 pandemic has made it even more important to prevent instability in the ringgit’s value.

Acknowledging the controversy over the fixed exchange rate his administration introduced in the aftermath of the AFC, he insisted that it had prevented the ringgit from continuing to be targeted by currency speculators at the time.

“When we set the value of the ringgit at 3.80 to the dollar and we guaranteed a supply of the currency at that value, the ringgit no longer fluctuated.

“Even currency traders could not affect the ringgit by dumping it to depress its value,” he said in a statement today.

Dr Mahathir said that both the World Bank and International Monetary Fund eventually came around to the peg despite their earlier criticism, and acknowledged that it helped prevent Malaysia’s situation from worsening at the time.

He also said a similar peg now would provide certainty to businesses that must borrow or import in foreign currency, as they could otherwise be hit by severe fluctuations in the ringgit’s value later.

The ringgit has declined sharply since March this year, losing 4.3 per cent of its value against the greenback since then.

It is currently trading near 4.38 to the dollar, down from around 4.20 at the start of the year.

The decline has been based on signals from the US Federal Reserve that it was finally raising interest rates this year, after years of keeping this at or near zero.