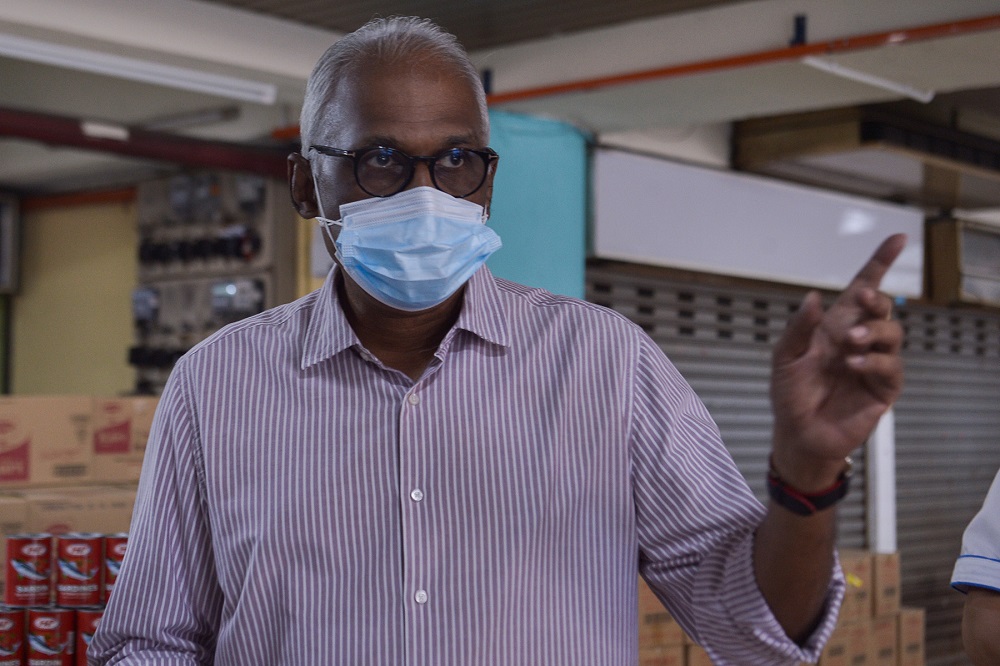

KUALA LUMPUR, Oct 1 — Klang MP Charles Santiago has urged the government to come up with a workers’ insurance scheme for informal sectors and improve the state of social security for older communities.

He said that in order to tackle the situation, the government must recognise the informal sectors that are outside of its jurisdiction as they represent a big pool of workers, especially seniors.

“Also a good number from my experience in my constituency, a lot of older women, not so much men, are working in the informal sector. And as you know there is no social protection in the informal sector, and therefore, you work on a daily basis and you get paid on a daily basis.

“So clearly in terms of trying to provide support, one of the proposals that I have been making now (or) later when I debate the 12th Malaysia Plan is to ask the government to have a workers’ insurance scheme designed specifically for the informal sector.

“And before the government does that, it needs to register the informal sector which has a big population of workers who are now outside of government’s jurisdiction,” he said during a United Nations Population Fund (UNFPA) Facebook session dubbed “Special Presentation: International Day of Older Persons 2021”.

When contacted by Malay Mail, the DAP man said that the workers scheme insurance can cover individuals who work as security guards, hairdressers, taxi drivers and others that are grouped under the informal sector.

He further said that the workers insurance scheme must cover a period of six to eight months after a retrenchment or layoff, and it might benefit approximately 4.9 million workers in the informal sector.

He also suggested a review of the Employment Insurance System (EIS) Act to benefit more workers.

A check by Malay Mail on the Social Security Organisation’s (Socso) website has found that the EIS Act does not cover domestic workers, self-employed workers, civil servants, and workers in statutory bodies and local authorities.

To be eligible for the EIS Act, a person must be a Malaysian citizen, aged 18 to 60, working in the private sector, and employed based on a contract of service, except for individuals above 57 who have never made any contributions.

Charles also highlighted in the discussion that one of the problems that the older generation faces is a lack of savings.

He claimed that it was reflected in the Employees Provident Fund (EPF) studies where people were asked to withdraw from their own savings account to cushion the repercussions of Covid-19 pandemic.

“So we can see a lot of older people, especially in the B40 (bottom 40 per cent income group) category and also lower level of M40 (middle 40 per cent income group) who actually do not have savings in order to support themselves or even put themselves in the hospital, for example,” he added.

On September 25, national news agency Bernama reported that as many as 54 per cent of EPF contributors aged 54 have savings of less than RM50,000 for retirement.

EPF Operations Division Deputy Chief Executive Officer, Datuk Mohd Naim Daruwish was quoted as saying that in total, only 34 per cent of EPF active contributors reached the level of basic savings by age. — Bernama