KUALA LUMPUR, July 22 — I have been reeling from painful flashbacks since the debate began raging over the different pros and cons of the much-hated Goods and Service Tax (GST) and the impending Sales and Services Tax (SST).

In these recollections, my business partners and I are staring at an Excel spreadsheet, tearing the hair from our heads and moaning piteously. We were woefully unprepared and, like pretty much every Malaysian enterprise big and small in late 2015, we ran right into a brick wall.

Our little public relations consultancy had a cash flow problem. We were profitable, but the government of Malaysia was sitting on our cash.

As the collection agents for former prime minister Datuk Seri Najib Razak’s administration — thanks, man! — We invoiced our clients the requisite 6 per cent GST. Then we had to pay, in real money, the amount of GST invoiced because the tax had been incurred, even though we had not yet been paid.

We resentfully passed to the Customs Department our cold, hard cash, in advance. Then we waited for our clients to pay us. But of course they were in the same boat. We all were. Up and down the supply chain, from the Bursa Malaysia-listed companies to the neighbourhood mini-market, we were all transferring cash from our bank accounts to the government.

I’m sure the Customs Department didn’t mean to be slow in making refunds. And, maybe we shouldn’t have extended reasonable payment terms. Why give 30-, 60-, or 90-day payment terms to clients and customers when we should have said, “pay us yesterday please”. Right?

Anyway, now we know why our little ringgit was so desperately needed. But while the government’s debts — thanks, 1MDB! — were being serviced, my partners and I went without our salaries — thanks, Jho!

I’m sure other business people out there did too. We drew down on savings and racked up some personal debt but we survived. We didn’t have to fire anyone, but there must have been some who did. Others didn’t replace staff who retired or give jobs to fresh graduates. Or maybe they didn’t buy the machinery they needed or didn’t restock their inventory.

Even now, I feel anxious recalling those times. I remember reading about a neighbourhood sundry shop, a family-owned business run by an elderly couple who were probably getting by okay until GST ate up all their money.

I remember quiet shopping centres and empty cinemas. I remember I thought I got too little change from a 7-Eleven cashier, and then realised “oh, it’s the GST”. I remember the first time I paid GST for tampons.

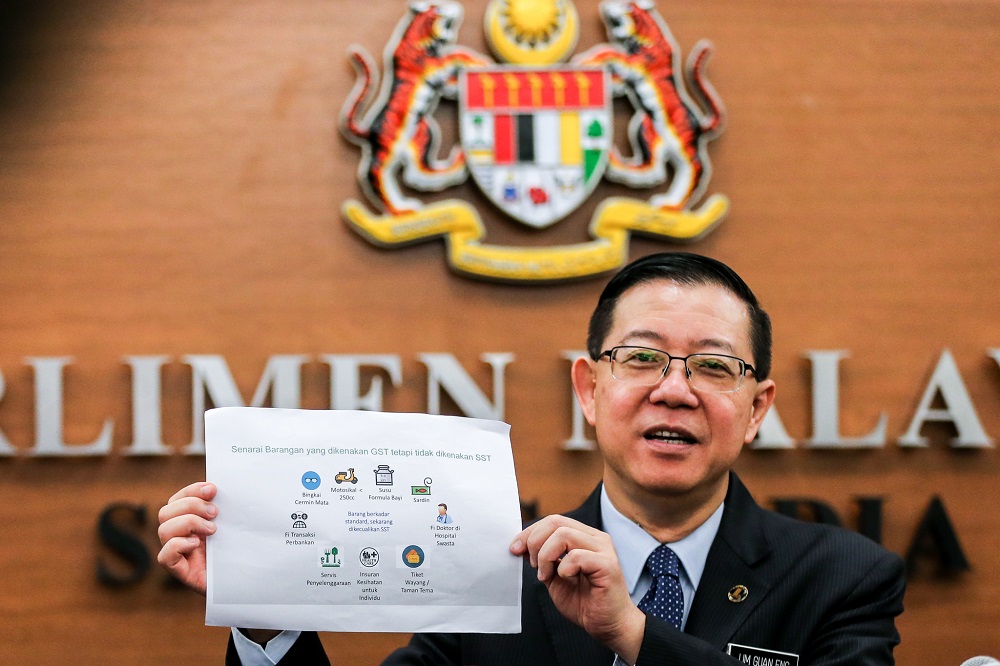

I remember when nothing I bought in a supermarket or a pharmacy was taxed, nor my panties and bras, nor my spectacles. There must be parents who remember when disposable diapers were not taxed. Or colouring pencils. Or ball point pens. Or school shoes. Or slippers. My Muslims friends will remember the days when they didn’t pay GST on prayer rugs, or tudung kepala or prayer beads.

Ya, ya, ya, GST is a more efficient, more transparent tax. Being able to claim back a portion of GST was supposed help businesses reduce the cost of making goods and providing services. These cost savings were supposed to have been passed on to consumers.

So what if the SST will be hidden in the final price we pay at the till, and we won’t know exactly how many ringgit and sen that is.

But we do know the Mahathir administration’s SST is expected to cost a whopping RM20 billion less — LESS — than Najib’s GST. That’s RM20 billion that will stay in the economy, circulating, generating jobs, paying salaries, feeding families.

From the first day of September, I’m going to have to put the SST on our invoices to our clients. But then I’m going to the supermarket, and I won’t have to pay GST on mosquito coils, and brooms, and mops, and feather dusters, and senduk and matches. And tampons. Thanks, Doc!

* Lee Siew Lian is a former financial journalist and is currently a public relations consultant. She is also a Malay Mail reader.