KUALA LUMPUR, Aug 10 — In 2018, 48 per cent of Malaysians were able to raise RM1,000 as emergency funds.

Three years later, just 53 per cent of Malaysians were able to do the same.

The data, collated under Bank Negara Malaysia's (BNM) triennial Financial Capability and Inclusion Demand Side Survey in 2021, also revealed worrisome statistics on dealing with unexpected expenses — 27 per cent of Malaysians save less than five per cent of their income and 11 per cent do not save at all.

With significant income shocks and higher costs of living post Covid-19, BNM's Museum and Art Gallery has curated an exhibition aimed at instilling financial literacy through the most fundamental of financial management — savings.

“This data suggests that while digital banking offers convenience and accessibility, it does not inherently foster improved saving habits,” Bank Negara Malaysia (BNM) Museum and Art Gallery deputy director Alnizah Shamsudeen told Malay Mail recently.

Titled “Never Too Late”, the exhibition is at Sasana Kijang where BNM's Museum and Art Gallery is located from now until January 31, 2025.

Alnizah said the exhibition aims to achieve several objectives that complement BNM's existingfinancial literacy advocacy through the emphasis on savings and sound financial management.

“In essence, the exhibition serves as a practical extension of BNM's existing financial literacy initiatives.

“It provides a hands-on learning environment that reinforces the key messages promoted through other programs, making financial education more engaging and accessible for a broader audience,” she said.

Preparing an umbrella before the rain

With encouragement in mind, curator Amirul Asyraf Ahmad Sabri explained the origin of the exhibition's title reflects the central bank's mandate to inspire and motivate visitors to take control of their financial future.

“So the idea behind the ‘Never Too Late’ exhibition, if we can rephrase it, is that it's never too late to start saving or it's never too late to learn financial management regardless of your age or financial situation because we know financial education is something you have to do in a lifelong journey,” he said.

Co-curator Gabrielle Evelyn Lee added that a lot of Malaysians claim they are unaware they can start saving at different stages of their life and usually assume saving would only benefit them if it had been done during their childhood.

“That is actually untrue, anyone can start at any age, it can be simple as practical tips or steps on how to build savings from earning your wages and segregating them for saving and necessities; all the way to the end where one falls into debt and how to get out, all of those are included in this exhibition,” she explained further.

But surely any attempt to inculcate a saving habit and sound financial management is a daunting task for an ordinary person to perform, yet the ongoing exhibition proved otherwise.

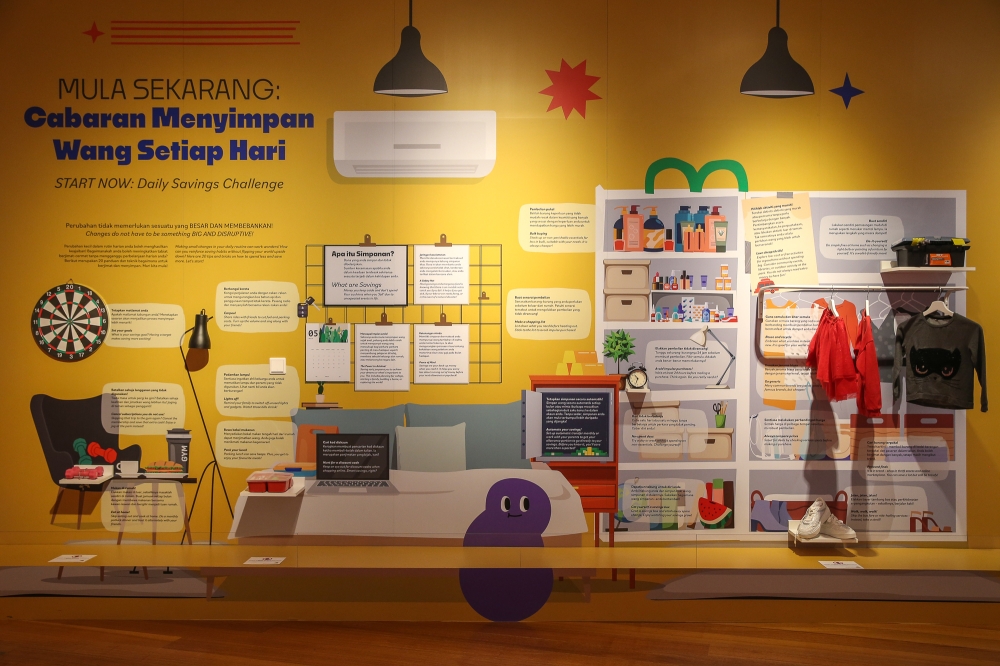

“Our exhibition is very audience-oriented (approach) where most of them comprised the general public which is why we sought to make it enjoyable and accessible.

“The contents we have here on finance and economy, they can be seen as intimidating, that is why we want to make it friendly and easy to digest where visitors can immerse themselves in the colours and vibrancy of the gallery," she said.

During Malay Mail's tour of the gallery, vibrant colours, interactive displays and quirky designs immediately gave the impression of fun.

Notable exhibits include a wall display of savings boxes or 'piggy banks' over the years from pre-independence to post-independence; a marketplace for role playing and a life size snake-and-ladder board game with human beings as the game piece and an oversized die.

On the life size board game, Amirul Asyraf explained that the game design took into account the number of participants and uncomplicated nature of the game to encourage self-exploration.

“When we opened the exhibition the first impression we got was whether the exhibition caters to children,” Amirul Asyraf said, adding that the curation team sought to make each part of the exhibits as relatable and user-centric to every generation as possible.

Overwhelming responses

Since the exhibition's opening on June 12, Gabrielle said the response has been overwhelming with over 25,000 visitors having clocked in in just over a month.

“From our feedback received during this one month period, we observe a 98 per cent improvement on financial literacy from visitors who rated themselves post-exhibition,” she said.

Moving forward, both Gabrielle and Amirul Asyraf expressed optimism about the exhibition and the museum's role in conveying the message that financial education is a lifelong journey and anyone can start or improve their financial habits at any time.

“This (exhibition) is one of the avenues for them to have a continuous conversation on financial literacy and hopefully inculcate better financial habits going forward.

“It is a lifelong journey when learning about financial literacy with the methods continuing to evolve, the tools ever growing, there will be new platforms and further enhancements, and it's never too late to start learning it of which this particular museum has dedicated itself to,” they said.

For those interested in the exhibition, it is open from Tuesday to Sunday (10am to 5pm) and is free.