KUALA LUMPUR, July 6 — Offering health insurance as an employee benefit is one of the most effective steps employers can take to attract talent.

It also helps employers increase workplace productivity, boost morale and create a positive work culture.

While most large corporations include health insurance and medical benefits in their remuneration package, many small and medium enterprises (SMEs) and micro SMEs simply can’t afford such benefits for their staff.

The National Health and Morbidity Survey 2019 found that only 22 per cent of the population is insured with personal health insurance.

Furthermore, a shocking 43 per cent of the respondents said they were unable to afford personal health insurance.

On average, Malaysians were found to spend more on healthcare at about 5.1 per cent of their monthly household expenditure in the 2019 survey.

Recognising the need to bridge the protection gap and make insurance more accessible and affordable to SMEs, Tune Protect Life has introduced the Tune Protect SME EZY insurance plan.

The insurance package comes with a three-year fixed premium plan to give SME owners peace of mind without worrying about medical inflation or rising premiums for at least three years.

That means business owners only need to pay the same amount annually during that entire period.

The plan also comes with a health and wellness rewards programme called Activ8, which aims to boost employees’ health and productivity through annual health screening and coaching programmes.

Tune Protect is the first in the market to offer employee insurance online, and business owners who make the purchase via their official website will enjoy a 10 per cent rebate.

The insurer also promises a very swift response of: three minutes for an online quotation, a response within 3 hours of each query submitted and a claims pay-out within three days upon approval.

Tune Protect has introduced a microsite for business owners to obtain their customised insurance solutions through just a few clicks.

To get started, click here and you will land on the SME EZY microsite to purchase a solution that suits your requirements.

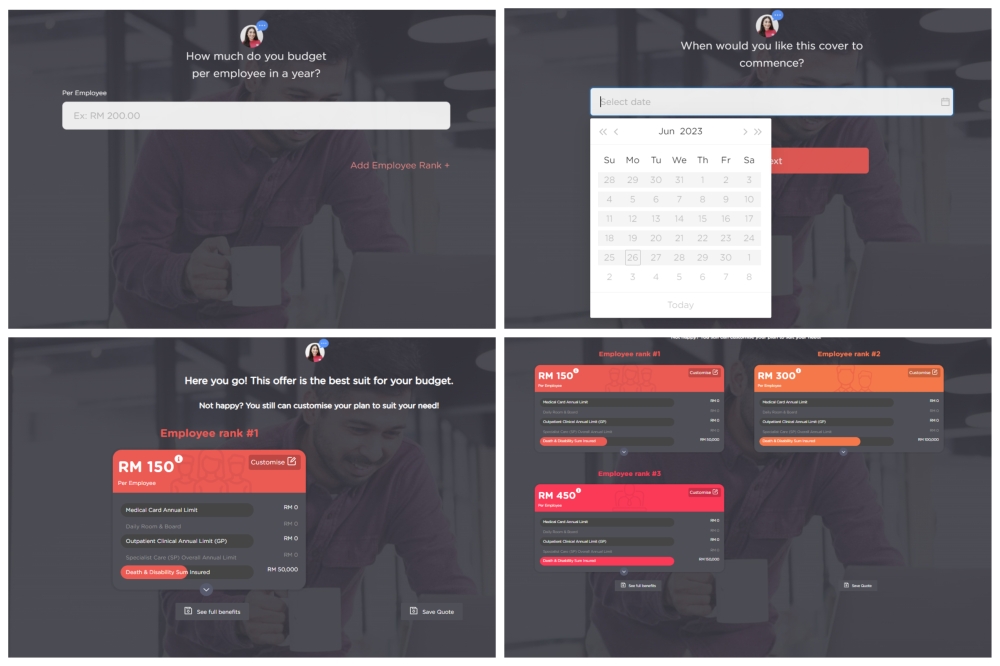

Simply key in the existing number of employees and your allocated budget per head for a year.

Next, choose the commencement date of the premium and press next to get the recommended insurance plan which shows the medical card annual limit, outpatient clinical annual limit as well as death and disability sum insured.

The website allows employers to purchase insurance plans within their budget and if they are not satisfied with the recommended plan, they can customise them according to their needs.